FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

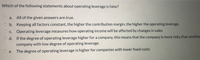

Transcribed Image Text:Which of the following statements about operating leverage is false?

O a.

All of the given answers are true.

O b. Keeping all factors constant, the higher the contribution margin, the higher the operating leverage.

OC.

Operating leverage measures how operating income will be affected by changes in sales

O d. If the degree of operating leverage higher for a company, this means that the company is more risky than another

company with low degree of operating leverage.

The degree of operating leverage is higher for companies with lower fixed costs

O e.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In general, a firm with low operating leverage also has a small proportion of its total costs in the form of variable costs. T/F True Falsearrow_forwardWhich of the following statements is most accurate? A. Financial leverage is directly related to operating leverage. B. Increasing the corporate tax rate will not affect capital structure decisions. C. A firm with low operating leverage has a small proportion of its total costs in fixed costs. D. Total costs can be calculated as net income minus total revenue.arrow_forwardConsider the following statements: 1. Businesses that are capital intensive tend to have high operating gearing. 2. Businesses with relatively high total variable cost compared with their total fixed cost, at their normal level of activity, are said to have high operating gearing. Are the above statements true or false?arrow_forward

- Only typed solutionarrow_forwardDegree of operating leverage (DOL) measures the sensitivity of OCF in response to changes of The higher the DOL, the the volatility of a firm's operating income. Select one: a. sales quantity; lower O b. sales quantity; higher O c. fixed costs; lower O d. fixed costs; higher O e. variable costs; higherarrow_forwardEverything else equal, an industry with more leverage will have a: higher return on assets. higher return on equity. lower return on equity. Both A & Barrow_forward

- A competitive firm O Has the market power to compete effectively. O Confronts a downward-sloping firm demand curve. O Is large enough relative to the market to be taken into account by competitors. OIs a price taker.arrow_forwardCompanies often use leverage to augment profits. Based on what you learned this week, please explain the following in detail: With regards to Operating Leverage, please explain why a company with HIGH Operating Leverage faces greater financial risk in a declining sales period compared to a company with LOW Operating Leverage. (HINT: The key here is the relation between fixed costs and variable costs.) What does a business's Contribution Margin represent? What does the Contribution Margin have to do with Operating Leverage?arrow_forward10. Other things being equal, the higher the degree of operating leverage, the profit opportunity with increased sales and risk of loss with a decrease in sales. A) Lower; higher B) Higher; lower c) Lower; lower D) Higher; higher Your answer is Explain your answer:arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education