Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

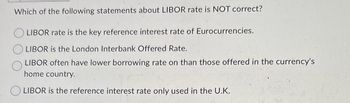

Transcribed Image Text:Which of the following statements about LIBOR rate is NOT correct?

LIBOR rate is the key reference interest rate of Eurocurrencies.

LIBOR is the London Interbank Offered Rate.

LIBOR often have lower borrowing rate on than those offered in the currency's

home country.

LIBOR is the reference interest rate only used in the U.K.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Under a managed-float exchange rates regime, if the rate of inflation in Australia is less than the rate of inflation of its trading partners, the AUD will likely: a. depreciate against foreign currencies. b. be officially devalued by the Reserve Bank. c. appreciate against foreign currencies. d. be officially revalued by the Reserve Bankarrow_forwardDoes the Fed have complete control over U.S. interest rates? That is, can it set ratesat any level it chooses? Why or why not?arrow_forwardExchange rate is:Select one:a. All of the given answers.b. The rate at which one currency can be exchanged for another.c. Not defined in AASB 121.d. The difference between the currency rates.arrow_forward

- 3arrow_forwardFannie Mae and Freddie Mac play an important role in the mortgage market. True False The effective yield on foreign money market securities is not affected by exchange rate movements. True Falsearrow_forwardSuppose that the nominal interest rate in the euro area is 2%, and the nominal interest rate in Switzerland is 4%. Suppose inflation is expected to be 0.5% in the euro area. If the Fisher Effect holds, then the real interest rate in the euro area is approximately the expected inflation in Switzerland is O2%; impossible to determine. 1.5%; 2.5% 2.5%; 0.5% None of the above is correct. 1.5%; 0.5% andarrow_forward

- According to the flow of balance of payment (BOP) approach to exchange rate determination, there are financial measures being put in place by countries with managed floating exchange rate regime in order to cope with a deficit in its BOP.In order to control those countries currency volatility and opt for stabilization what will happen if they run persistent BOP deficits for a couple of years? T-Mobile., like many emerging telecom carriers, has only limited and infrequent access to domestic debt and equity markets. As a financial management at Ait, how would you be able to demonstrate to the Board of Directors and convince them as to why the Net Present Value and Internal Rate of Return capital budgeting decision rules sometimes provide different rank orderings of investment project alternatives? Equipment that costs $15,000 and generates a $5,000 annual return would appear to "pay back" on the investment in 3 years. If economists expect inflation to rise 30 percent annually, what…arrow_forward1.Assume that the yen is selling at a forward discount in the forward-exchange market. Then, most likely a . interest rates are declining in Japan. b . this currency is gaining strength in relation to the dollar. c . interest rates are higher in Japan than in the United States. d . this currency has low exchangerate risk.arrow_forwardWhich of the following are reasons why an MNC might issue bonds in a particular foreign market? Check all that apply. There is stronger demand for bonds issued by the MNC in a foreign market as opposed to the domestic market. The currency in that foreign market is expected to appreciate against the MNC's home currency. There is a lower interest rate in that foreign country. The MNC intends to finance a project in a specific country and in a specific currency. If there is for a bond, a bondholder may not be able to sell a bond at the desired time or may have to decrease the price of their bonds in order to sell them. The risk of this occurrence is known as risk.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education