FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

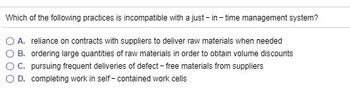

Transcribed Image Text:Which of the following practices is incompatible with a just-in-time management system?

A. reliance on contracts with suppliers to deliver raw materials when needed

B. ordering large quantities of raw materials in order to obtain volume discounts

C. pursuing frequent deliveries of defect-free materials from suppliers

D. completing work in self-contained work cells

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- You mention changes and revisions to the standard cost systems. If you were the Operations manager of a manufacturing firm, what control would you have in place to assure those changes were proper and accurate? What assertions would apply here?arrow_forwardManufacturing Decisions Whenever the units manufactured differ from the units sold, finished goods inventory is affected. In analyzing operating income, such increases and decreases could be misinterpreted as operating efficiencies or inefficiencies. Each decision-making situation should be carefully analyzed in deciding whether absorption or variable costing reporting would be more useful. All costs are controllable in the long run by someone within a business. For a given level of management, costs may be controllable costs or noncontrollable costs. The production manager for Saxon, Inc. is worried because the company is not showing a high enough profit. Looking at the income statements on the Absorption Statement and the Variable Statement, he notices that the operating income is higher on the absorption cost income statement. He is considering manufacturing another 10,000 units, up to the company's capacity for manufacturing, in the coming year. He reasons that this will boost…arrow_forwardWhich of the following statements is false? A. The departmental and traditional costing methods create cost distortions when there is significant costs associated with batch activities. B. The manufacturing overhead is applied to product by applying the POHR to actual cost drivers that occur during the production period C. The activity based costing system provides the most accurate product costing results D. Actual manufacturing overhead costs and the actual cost driver amounts are used to create the predetermined overhead rate (POHR)arrow_forward

- Darrow_forwardManufacturing Decisions Whenever the units manufactured differ from the units sold, finished goods inventory is affected. In analyzing operating income, such increases and decreases could be misinterpreted as operating efficiencies or inefficiencies. Each decision-making situation should be carefully analyzed in deciding whether absorption or variable costing reporting would be more useful. All costs are controllable in the long run by someone within a business. For a given level of management, costs may be controllable costs or noncontrollable costs. The production manager for Saxon, Inc. is worried because the company is not showing a high enough profit. Looking at the income statements on the Absorption Statement and the Variable Statement, he notices that the operating income is higher on the absorption cost income statement. He is considering manufacturing another 10,000 units, up to the company’s capacity for manufacturing, in the coming year. He reasons that this will boost…arrow_forwardThe following statements refer to organisations that use service costing:(i) The service provided will be a homogenous product.(ii) The cost of materials is relatively small compared to labour, expenses and overheads.(iii) A problem with service costing is the difficulty in defining a realistic cost unit.(iv) Inventory levels are generally high in-service costing industries.Which of the above statements are correct?a) (i) and (ii)b) (ii) and (iii)c) (ii) and (iv)d) (i) and (iv)arrow_forward

- What features of the cost accounting system would be expected to prevent the omission ofrecording materials used in production?arrow_forwardOrganizations are motivated to use multiple indirect cost pools instead of a single indirect cost pool when Select one: O a. Multiple Indirect cost pools are needed to conform to external reporting requirements b. manufacturing overhead costs are difficult to control c. the cost drivers for the multiple indirect cost pools are different from the cost driver of the single indirect cost pool d. none of the optionsarrow_forwardWhich of the following statements is false? Cost allocations such as activity-based costing allow manager to evaluate profitability of their products. A budget is a quantitative plan for acquiring and using financial and other resources over a specific forthcoming time period. A detailed activity-based costing system is costly to implement. Using different allocation base does not affect manufacturing overhead costs allocated to each product.arrow_forward

- Accounting for lean operations requires fewer transactions because a. combined materials and conversion costs are transferred to finished goods b. costs are accumulated in one department and then transferred to the next department c. costs are transferred from department to department allowing for better control of costs d. large batches of inventory are combined into a smaller number of transactionsarrow_forwardAirco Company is tempted to consider support department costs to be facility-level costs that do not need to be applied to products. Which of the following explains what is misguided about this approach? a.Product costs may be inaccurate because support department services may be used more heavily by some products than others. b.Product costs may be inaccurate because incorrect cost drivers are used. c.Product costs may be inaccurate because straight-line depreciation on factory equipment is treated as a general and administrative expense on the income statement. d.Product costs may be inaccurate because direct labor and direct materials are not correctly accounted for in the product costing system.arrow_forwardWhich of the following would be classified as an external failure cost on a quality cost report? Multiple Choice O Reentering data because of keying errors. Customer returns arising from quality problems. Test and inspection of in-process goods. Rework labor and overhead.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education