Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

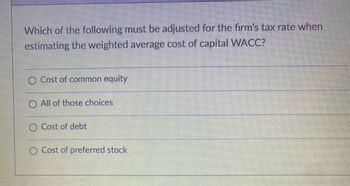

Transcribed Image Text:Which of the following must be adjusted for the firm's tax rate when

estimating the weighted average cost of capital WACC?

O Cost of common equity

O All of those choices

Cost of debt

O Cost of preferred stock

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Discuss why evaluating vertical equity simply based on tax rate structure may be less than optimal.arrow_forwardExplains how the Capital Asset Pricing Model (CAPM) helps to determine the performance of the company's shares.arrow_forwardWhile the Weighted Average Cost of Capital reflects the risk perceived by in investors the “real risk” is ____________arrow_forward

- Dividend policy may be affected by firm level as well as macroeconomic level factors. Select FIVE variables (at least 2 firm-level factors/variables and at least 2 macroeconomic factors/variables) from the list shown below. Explain and discuss the predicted impact of selected factors on dividend policy using relevant theories. i.e. what theories help to predict the positive or negative impact on the dividend payout and why. FIRM-LEVEL FACTOR/VARIABLE Asset growth rate Positive NPV investment opportunities Capital intensity of the production process Free cash flow generated Number of individual shareholders Relative tightness of ownership coalition Size of largest block holder MACROECONOMIC FACTOR/VARIABLE Transaction costs of security issuance Personal tax rates on dividend income Personal tax rates on capital gain Importance of institutional investors Corporate governance power of institutional investors Capital market, relative to intermediated (bank) financingarrow_forwardWhat is the investor’s expected after-tax internal rate of return on equity invested (ATIRR)?arrow_forwardHow does the % of ownership a company has in an investment affect them? Please explain.arrow_forward

- Please answerarrow_forwardA firm’s weighted average cost of capital should not do which one of the following? Group of answer choices measure the cost of short-term sources of funds measure cost on a marginal basis measure the cost of long-term sources of funds measure cost on an after-tax basisarrow_forwardUse the following information to answer the following question(s). a) What is the percentage of common stock in Sumitomo's weighted average cost of capital? b) What is the percentage of debt in Sumitomo's weighted average cost of capital? c) What is the percentage of preferred stock in Sumitomo's weighted average cost of capital? d) What is the total capital that should be used in computing the weights for Sumitomo's WACC?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education