ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

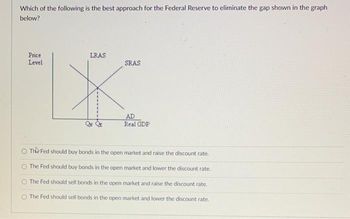

Transcribed Image Text:Which of the following is the best approach for the Federal Reserve to eliminate the gap shown in the graph

below?

Price

Level

LRAS

SRAS

AD

Real GDP

The Fed should buy bonds in the open market and raise the discount rate.

The Fed should buy bonds in the open market and lower the discount rate.

The Fed should sell bonds in the open market and raise the discount rate.

The Fed should sell bonds in the open market and lower the discount rate.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The Fed can make it cheaper for banks to borrow from the___ by lowering the discount rate. A)central bank B)excess reserve C)monetary base D)New York Fedarrow_forwardCalculate what the federal funds rate should be using the Taylor Rulearrow_forwardIn what ways does the Fed utilize their monetary policy tools to affect or counter-balance fiscal policy?arrow_forward

- E 1.7 The hypothetical information in the table below shows what the values for real GDP and the price level would have been in 2019 if the Federal Reserve did not use monetary policy: 4¹ F3 Year 2018 2019 49 $ 4 a) If the Fed wanted to keep real GDP at its potential level in 2019, should it have used an expansionary policy or a contractionary policy? Should the trading desk have bought T- bills or sold them? b) Suppose the Fed's policy was successful in keeping real GDP at its potential level in 2019. State whether each of the following would be higher or lower than if the Fed had taken no action: R a. Real GDP b. Full-employment real GDP c. The inflation rate d. The unemployment rate c) Draw an aggregate demand and aggregate supply graph to illustrate your answer. Be sure that your graph contains LRAS curves for 2018 and 2019; SRAS curves 2018 and 2019; AD curve for 2018 and 2019, with and without monetary policy actions; and equilibrium real GDP and the price level in 2019 with and…arrow_forwardSuppose Federal Reserve wants to reduce money supply. How could Federal Reserve reduce money supply through the open market operations? Show your answers in a diagram. Your diagram should also show interbank loans. To reduce money supply, should Fed increase or decrease Fed funds rate? For the Fed Funds rate, who is a borrower? Who is a lender? For the discount rate, who is a borrower? Who is the lender?arrow_forwardBriefly describe the main policy tools that Fed use in conducting its monetary policy?arrow_forward

- An economy begins in long-run equilibrium. a. Consider the formulation of an oil cartel. Illustrate and explain how this affects prices and output over time. b. If the goal of the Fed is to stabilize the output, what should the Fed do with the money supply in response to this change? Illustrate and explain.arrow_forwardExplain how lowering the reserve requirement ratio by the central bank will affect the aggregate demand at any given price level. Use relevant graphs to support your answer.arrow_forwardRead the event The Federal Reserve raises reserve requirements. What would likely result from this event? A. An economy would see a slight decrease in aggregate demand. B. Interest rates on loans decline. C. Consumer demand would increase thus increasing prices. D. Inflation would reach levels that are acceptable for full employment.arrow_forward

- 1. What are the political and economic limitations upon (a) fiscal policy and (b) monetary policy? 2. What are the implications of a liquidity trap for the Federal Reserve?arrow_forwardExplain why the Reserve Supply is perfectly elastic at Discount Window Rate.arrow_forwardWhat action did the FOMC take, if any, regarding the level of the fedfunds rate? Why did it make this choice?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education