FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

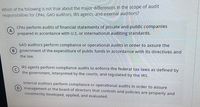

Transcribed Image Text:Which of the following is not true about the major differences in the scope of audit

responsibilities for CPAS, GAO auditors, IRS agents, and internal auditors?

CPAS perform audits of financial statements of private and public companies

(A)

prepared in accordance with U.S. or international auditing standards.

GAO auditors perform compliance or operational audits in order to assure the

B government of the expenditure of public funds in accordance with its directives and

the law.

IRS agents perform compliance audits to enforce the federal tax laws as defined by

the government, interpreted by the courts, and regulated by the IRS.

Internal auditors perform compliance or operational audits in order to assure

management or the board of directors that controls and policies are properly and

consistently developed, applied, and evaluated.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Who is responsible for establishing auditing standards foraudits of U.S. public companies? Who is responsible for establishing auditing standardsfor U.S. private companies? Explainarrow_forwardGovernmental auditors’ independence and objectivity are enhanced when they report theresults of an audit assignment directly toa. Managers of the government agency under audit and in which the auditors are employed.b. The audit committee of directors of the agency under audit.c. Political action committees of which they are members.d. The congressional committee that ordered the audit.arrow_forwardHow does the Single Audit Act work?What effect has this legislation had on governmental organisation auditing?What formats do auditors' reports and opinions take?arrow_forward

- How does Federal Law impact the scope, methodologies, and reporting requirements for integrated, performance, and other audits conducted within the public sector, and what are the key challenges auditors face in ensuring compliance with legal mandates while maintaining audit quality and transparencyarrow_forwardHow do the major provisionsof the Sarbanes–Oxley Actaffect a public company’s auditprocedures?arrow_forwardIf a corporation may be violating federal and state laws governing environmental concerns, which one of the following types of audit will best assist in ascertaining whether such situations may exist?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education