Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

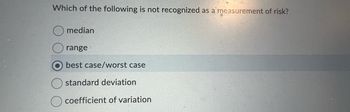

Transcribed Image Text:Which of the following is not recognized as a measurement of risk?

median

range

best case/worst case

standard deviation

coefficient of variation

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The standard deviation of.alt=”f$ar{X},f$ “> is usually called the A.standard error of the sample B.randomized standard error C.standard error of the mean D.standard error of the populationarrow_forwardWhy do some investors prefer to use Lower Partial Standard Deviations(LPSD) as compared to the standard deviation?arrow_forwardWith regard to dynamic risk strategies, MGRM was subject to: Group of answer choices B. Backwardation D. Both A & B C. Non-basis risk A. Contangoarrow_forward

- The _______________ the coefficient of variation, the ______ the risk. a. higher; lower b. more stable; higher c. lower; higher d. lower; lowerarrow_forwardWhy do some investors prefer to use Lower Partial Standard Deviations (LPSD) as compared to the standard deviation?arrow_forwardWhat are the characteristics of Probability Proportionate to Size (PPS) sampling?arrow_forward

- True or false? Beta of MSFT is 0.7 and beta of RCL is 1.33. One can conclude that unsystematic risk of RCL is higher than unsystematic risk of MSFT.arrow_forwardWhat is the primary use of a p-value in statistics? a) To measure the central tendency b) To assess the strength of evidence against the null hypothesis c) To calculate the mean d) To measure the spread of dataarrow_forwardWhich of the following statements are correct? I.The standard deviation is a measure of risk.II.The variance of yearly returns is roughly the variance of monthly returns multiplied with 12.III.To decide whether asset A is more risky than asset B we can either use their standard deviations or their variances. Group of answer choices II and III only I, II and III I and II only I and III onlyarrow_forward

- Which measure of central tendency is best used for categorical data? a) Mean b) Median c) Mode d) Standard Deviationarrow_forwardWhich one of the following statements is correct concerning unsystematic risk? An investor is rewarded for assuming unsystematic risk. Beta measures the level of unsystematic risk inherent in an individual security. Eliminating unsystematic risk is the responsibility of the individual investor. Standard deviation is a measure of unsystematic risk. Unsystematic risk is rewarded when it exceeds the market level of unsystematic risk. оо O Oarrow_forwardThe sample size of the test of controls varies directly with: Expected Population Deviation Rate Tolerable Rate Risk of Assessing Control Risk Too Low A. Yes Yes No B. No No Yes C. Yes No No D. No Yes Yes E. Yes Yes Yes A B C D Earrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education