Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN: 9780357033609

Author: Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

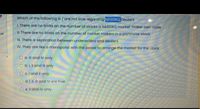

Transcribed Image Text:Which of the following is / are not true regarding NASDAQ Dealers

1. There are no limits on the number of stocks a NASDAQ market maker can trade

II. There are no limits on the number of market makers in a particular stock

of

II. There is separation between underwriters and dealers

IV. They are like a monopolist with the power to arrange the market for the stock

O a. IlI and IV only

O b. 1, Ii and II only

O c.I and Il only

O d. l, II, Il and IV are true

O e ll and IV only

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Which of the following would NOT be considered a secondary market transaction? Select one: O a. A buy order to a dealer for outstanding bonds of a company trading OTC. O b.A buy order to an investment banker for a new IPO stock offering. O CA buy order to a broker for shares of stock in a company on NYSE.arrow_forwardWhich of the following is/are true about specialists? I. Any investor who owns stock may be a Specialist. II. Specialists are used by the NASDAQ system II. Market and limit orders are transacted by specialists. IV. Specialists help maintain continuous trading (liquidity) O A. I, II, and III only B. I and IV only C.II, III, and IV only D.I only E. III & IVarrow_forwardPassive investors believe that: a. You can't beat the market so you should buy it b. They do not have time to pick stocks c. It is worth it to pay someone else to manage their investments 2. Which of the following describes a difference between the Nasdaq and the S&P500? They are weighted differently All stocks in the Nasdaq are traded on the same exchange The Nasdaq has fewer stocksarrow_forward

- Which is true about the primary market versus the secondary equity market? The primary market is for public companies and the secondary market is for private companies. The primary market is the NYSE and the secondary market is NASDAQ In the primary market, the company gets the proceeds of the stock sale. The primary market is much bigger than the secondary market.arrow_forwardSolve this attachment.arrow_forward[S1] When unrelated traders buy and sell stocks, the entity which issued the shares will be able to obtain additional financing. [S2] The underwriting syndicate is an underground group of individual assisting in the issuance of shares and the collection of cash investments. *a. Only S1 is true.b. Only S2 is true.c. Both are true.d. Both are false.arrow_forward

- . What does each of the three forms of the Efficient Markets Hypothesis say about each of thefollowing?a. Technical trading rules—that is, rules based onpast movements in the stockb. Fundamental analysis—that is, trying to identify undervalued or overvalued stocks based onpublicly available financial informationc. Insider tradingd. Hot tips from (1) Internet chat rooms, (2) closefriends unconnected with the company, or(3) close friends who work for the companyarrow_forwardM4arrow_forwardThe overthecounter (OTC) market is ________. A.a market where smaller, unlisted securities are traded B.an organized market in which all financial derivatives are traded C.a market in which low risk−high return securities are traded D.a highly liquid market as compared to NASDAQarrow_forward

- The table below provides stock market information for three different countries. Country A Perfect Country B semi perfect Country Ce imperfect Buyers and sellers' access to information about companies is a Cost of buying and selling shares Low In your opinion, in which country will the difference between market price and value of share be Moderate< High biggest and which country it will it be smallest? Explain Why.arrow_forwardWhich of the following is true of stock exchanges? Question 7Select one: a. Each exchange establishes its own requirements for the securities it lists. b. Apart from the annual fee, exchanges do not require firms to pay any other fee for the stock listing. c. Electronic trading began with the establishment of the over-the-counter market. d. The stocks of privately traded corporations are listed and traded on these exchanges.arrow_forwardAt time t you own one stock that pays no dividends, and observe that F(t, T) < St/Z(t, T). What arbitrage is available to you, assuming that you can only trade the stock, ZCB and forward contract? Be precise about the transactions you should execute to exploit the arbitrage.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT