FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

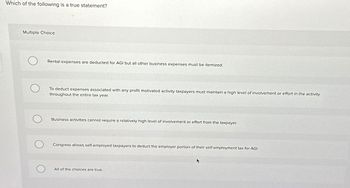

Transcribed Image Text:Which of the following is a true statement?

Multiple Choice

Rental expenses are deducted for AGI but all other business expenses must be itemized.

To deduct expenses associated with any profit motivated activity taxpayers must maintain a high level of involvement or effort in the activity

throughout the entire tax year.

Business activities cannot require a relatively high level of involvement or effort from the taxpayer.

Congress allows self-employed taxpayers to deduct the employer portion of their self-employment tax for AGI.

All of the choices are true.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Which one of the statement regarding itemized deductions in 2020 is false? Group of answer choices A.Itemized deductions provide relief to taxpayers whose ability to pay taxes has been involuntarily reduced. B.Itemized deductions subsidize desirable activities. C.Itemized deductions include medical expenses, taxes, mortgage interest, charitable contributions, and unreimbursed employee business expenses. D.Taxpayers only itemize deductions if they exceed their standard deduction.arrow_forwardThe self-employment tax base is 100% of self-employment income (Schedule C net income). True or False True Falsearrow_forwardA positive-balance employer has: a. an employee development program that promotes work-life balance and leadership skills. b. a reserve account whereby the benefits paid out are less than the taxes paid in. c. a reserve account whereby the benefits paid by the state = the taxes paid in. d. a reserve account whereby the benefits paid out exceed the taxes paid in.arrow_forward

- Taxpayers report taxable rental income and all deductible rental expenses on schedule c (form 1040) profit or loss from business. True or Falsearrow_forwardAc. Which of the following statements regarding the home office deduction is true? In order to qualify for the deduction, a portion of the taxpayer's home must be used regularly and exclusively to meet with clients or customers. A home office deduction is not allowed for using the home office for administrative or management activities only. The home office deduction is limited to the taxable income of the business before the deduction. A depreciation deduction is not allowed for a home office.arrow_forwardAssume your client wants to include travel and entertainment expenses in their tax deductions. Explain the type of documentation needed to support your client’s claim for including travel expense as business expense.Provide a circumstance where such a claim could trigger an IRS audit. Make sure you support your argument with clear tax rules and regulations.Your client is claiming the concert tickets he purchased as a business expense.Use your understanding of the tax laws to explain a situation where your client can claim the expense deduction as a business expense and another example where your client cannot.arrow_forward

- Recognition of tax benefits in the loss year due to a NOL carry back involves: O The establishment of an income tax refund receivable. Only a note to the financial statements. The establishment of a deferred tax liability. O The establishment of a deferred tax asset.arrow_forwardFirm E must choose between two alternative transactions. Transaction 1 requires a $9,150 cash outlay that would be nondeductible in the computation of taxable income. Transaction 2 requires a $14,800 cash outlay that would be a deductible expense. Required: a. Determine the after-tax cost for each transaction. Assume Firm E's marginal tax rate is 25 percent. b. Determine the after-tax cost for each transaction. Assume Firm E's marginal tax rate is 45 percent.arrow_forwardWhich of the following is an example of a tax credit available to businesses? A) Depreciation B) Net operating loss carryforward C) Research and development (R&D) tax credit D) Business expensesarrow_forward

- IMPORTANT: PLEASE ANSWER CORRECTLY AND ILL LIKE THE QUESTION. Exercise 19-04 (Part Level Submission) Kingbird Company reports pretax financial income of $73,500 for 2020. The following items cause taxable income to be different than pretax financial income. 1. Depreciation on the tax return is greater than depreciation on the income statement by $17,600. 2. Rent collected on the tax return is greater than rent recognized on the income statement by $19,900. 3. Fines for pollution appear as an expense of $10,500 on the income statement. Kingbird’s tax rate is 30% for all years, and the company expects to report taxable income in all future years. There are no deferred taxes at the beginning of 2020.arrow_forwardIf an individual itemizes deductions on his or her tax return, he or she may: a. deduct the gross unreimbursed medical expenses paid for the year b. deduct the net unreimbursed medical expenses paid for the year c. deduct 80% of the gross unreimbursed medical expenses paid for the year d. deduct 80% of the net unreimbursed medical expenses paid for the yeararrow_forward1. Which of the following is not taxable income? a.Interest b.Hobby income c.Child support payments d.Royalties e.Dividends 2. Generally, for an activity to be treated as a trade or business, which of the following is required: a.No more than intermittent effort toward the activity b.Regular and continual effort designed to seek profit c.Always generate a profit d.Organization as a corporation or partnership 3. To be deductible as the cost of special work clothing or uniforms: a.The clothing need not be required as a condition of the job, but must not be suitable for everyday use. b.The clothing must be required as a condition of the job, but can also be suitable for everyday use. c.The clothing must not be suitable for everyday use and must be required as a condition of the job. d.Only the cost of the clothing is included; upkeep is not deductible.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education