ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

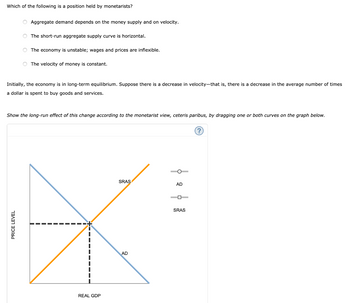

Transcribed Image Text:Which of the following is a position held by monetarists?

O Aggregate demand depends on the money supply and on velocity.

The short-run aggregate supply curve is horizontal.

The economy is unstable; wages and prices are inflexible.

PRICE LEVEL

The velocity of money is constant.

Initially, the economy is in long-term equilibrium. Suppose there is a decrease in velocity-that is, there is a decrease in the average number of times

a dollar is spent to buy goods and services.

Show the long-run effect of this change according to the monetarist view, ceteris paribus, by dragging one or both curves on the graph below.

REAL GDP

SRAS

AD

AD

SRAS

(?)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Suppose there is a simultaneous fiscal expansion and monetary contraction. We know with certainty that: Select one: O O O O O a. output will increase. b. output will decrease. c. the interest rate will increase. d. the interest rate will decrease. e. both output and the interest rate will increase.arrow_forward2. Create the T-entry for the Fed that goes together with the choice in the question abovearrow_forwardcurve to In the market for reserves, if the Federal Reserve Bank increases the required reserve ratio, this should shift the the O supply; left O supply: right O demand; left O demand; rightarrow_forward

- Consider the short run and the long run and then choose the statement that is correct. O A. The real interest rate is independent of the inflation rate in the long run. B. The real interest rate is dependent on the price level in the long run. C. In the short run, money market equilibrium determines the price level. D. In the short run, other things remaining the same, a given percentage change in the quantity of money brings an equal percentage change in the price level.arrow_forward1st attempt Assume that people in the economy have adaptive expectations. If the inflation rate has been stable at 2% in each prior year (because of passive monetary policies) and the central bank wants to lower unemployment, which policy should it implement? Choose one: O A. a policy that makes the inflation rate less than 2% O B. a policy that makes the inflation rate equal to 2% O C. a policy that makes the inflation rate greater than 2%arrow_forwardWhat are the immediate effects and the long-run effects if the Fed changes the quantity of money? If the Fed changes the quantity of money, the immediate effects are on and the long-run effects are on O A. the short-term nominal interest rate; the price level and the inflation rate B. the price level; the real interest rate and the inflation rate C. the inflation rate; the long-run nominal interest rate and the real interest rate D. the price level; the inflation ratearrow_forward

- and the real money If the inflation rate is higher than the rate of growth of the nominal money supply, the nominal money supply supply (M/P) O a. Stays constant; rises O b. Stays constant; falls O c. Rises; falls O d. Rises; stays constant mo thonarrow_forwardThe quantity theory of money begins with the equation of exchange, MV = PY, and then adds the assumptions that Select one: A. velocity and potential GDP are independent of the quantity of money. B. potential GDP and the price level are independent of the quantity of money. C. velocity and the price level are independent of the quantity of money. D. potential GDP and the quantity of money are independent of the price level. O E. velocity varies inversely with the interest rate, and the price level is independent of the quantity of money.arrow_forwardValue of Money O O 2 оо 1 I I I I I IMS₁ D 10 1 I | MS₂ B. D If the money supply is MS2 and the price level is 2, there is excess demand equal to distance AC. Money Demand supply equal to distance AC. demand equal to distance AB. supply equal to distance AB. None of the above is correct. Quantity of Moneyarrow_forward

- Assume, in the 3rd quarter of 2018 in the U.S., the velocity of money was 3.08 and the M2 money supply was $1,050 million. The average prices in the economy was $1.44. Based on this, what was the real GDP of the U.S. in the 3rd quarter of 2018. O a. $2,750 million O b.$1,250 millon Oc. $2,000 million O d. 52.250 millionarrow_forwarda) Which of the follwing monetary policy actions can be used to close an inflationary gap?O No change in the money supply to keep interest rates constant.ODecrease the money supply to decrease interest rates,OIncrease the money supply to increase interest rates.O Increase the money supply to decrease interest rates.O Decrease the money supply to increase interest rates. b) Assume the economy is initially at full-employment equilibrium. Suppose the economy slows down and uncertainty increases, reducing consumption and investment expenditures, in the short run, this shock willcause the economy to fall below full enployment. To move the economy to a full-employment equilibrium, the Fed could:O. decrease government spendingO. increase corporate tax ratesO. lower the federal fund rate targetO. increase government spending O. raise interest ratesarrow_forwardIn the short run, what would be the result of an increase in the monetary base? Assume the reserve ratio is unchanged. O a. Demand for money decreases. Ob. Demand for money increases. O c. Quantity demanded of money decreases. O d. Price level decreases. O e. Nominal interest rate falls.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education