Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

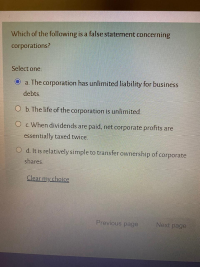

Transcribed Image Text:Which of the following is a false statement concerning

corporations?

Select one:

a. The corporation has unlimited liability for business

debts.

O b. The life of the corporation is unlimited.

O c. When dividends are paid, net corporate profits are

essentially taxed twice.

O d. It is relatively simple to transfer ownership of corporate

shares.

Clear my choice

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Which of the following statements are true regarding corporations? Note: You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect. ? Ownership rights cannot be easily transferred. ? Owners have unlimited liability for corporate debts. ? Capital is more easily accumulated than with most other forms of organization. ? Corporate income that is distributed to shareholders is usually taxed twice. ? It is a separate legal entity. ? It has a limited life. ? Owners are not agents of the corporation. ..........arrow_forwardAn individual provides accounting services to a corporation in exchange for stock. the shareholder must recognize income and the corporation may deduct or capitalize the expenditure as would be deemed appropriate. A. True B. Falsearrow_forwardDecide which of the following statements are true. I. In most circumstances, the owners of corporations enjoy reduced liability, increased liquidity and greater growth potential than owners of other forms of business. II. The term "LLC" or "Limited Liability Company", is a corporation that elects to limit liability for its shareholders through the use of off-shore and special purpose entities. II. The corporate form of business can help shield its owners from the liabilities of the corporation. Select one: O a. One is true. O b. Two are true. O C. All are true. O d. All are false.arrow_forward

- Which of the following is a disadvantage of the corporate form of organization? difficulty in raising capital unlimited liability of the owners finite life of the organization the tax treatment of dividendsarrow_forwardWhy do you think a single WACC is not applicable to all businesses in a corporation?arrow_forward* Explan.arrow_forward

- Public corporations: Multiple Choice are businesses whose stock is bought and sold on a stock exchange. are businesses owned by two or more people, each of whom is personally liable for the debts of the business. are businesses whose stock is bought and sold privately. are setup for non-profit purposes.arrow_forwardAn individual residing in Saskatoon has created a holding company to own the shares of their CCPC (which earns only active business income). The use of the holding company will permit which of the following? Select one or more: a. The holding company will receive dividends from the corporation, free of tax. b. The corporation's income will not be taxed. O c. The individual will receive dividends from the holding company, free of tax. O d. The individual will receive dividends from the corporation, free of tax.arrow_forwardA corporation may not deduct dividends paid to shareholders but is permitted to deduct reasonable compensation? True or Falsearrow_forward

- this question in the appropriate place on Blackboard. An S-Corp can only have how many shareholders max and how many classes of stock? Concepts /Terminology to Know: • LLC: Benefits of limited liability like a corporation but pass through taxes S-Corp: Know the four criteria, tax structure, pass through taxes... • Close corporation: simply means few shareholders, generally family run businesses Registration: States - usually go through Secretary of State • Governance: Business Judgment Rule • Blue Sky Laws: Securities laws at the state level • Federal Laws: Sarbanes Oxley, see chapter 8arrow_forwardThe accumulated earnings tax, which is imposed on corporations for the accumulation of earnings in excess of reasonable business needs, does not apply to: a. Closely-held corporations. b. Widely-held corporations. c. Corporations subject to the personal holding company tax. d. Both "Widely-held corporations" and "Corporations subject to the personal holding company tax". e. All of these choices are correct.arrow_forwardWhich of the following characteristics of a corporation limits a stockholder's loss to the amount of his or her investment in the stock of the corporation? Question 7Answer a. Separate legal entity b. Separation of ownership and management c. Transferability of ownership d. Limited liabilityarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education