ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

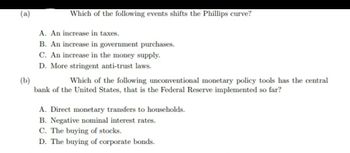

Transcribed Image Text:Which of the following events shifts the Phillips curve?

A. An increase in taxes.

B. An increase in government purchases.

C. An increase in the money supply.

D. More stringent anti-trust laws.

(b)

Which of the following unconventional monetary policy tools has the central

bank of the United States, that is the Federal Reserve implemented so far?

A. Direct monetary transfers to households.

B. Negative nominal interest rates.

C. The buying of stocks.

D. The buying of corporate bonds.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- classical economists a. argued that money supply determined aggregate demand b. believed that the quantity of money influences interest rates and real wages c. regarded monetary policy as unimportant since quantity of money does not determine price level. d. that prices would increase more than proportionate to an increase in money supplyarrow_forwardAccording to Monetarists, what should the government do if unemployment is 4% and inflation is 12%? Select one: a. Decrease the supply of money b. Decrease government spending c. Raise taxes d. Do nothing e. Lower interest ratesarrow_forwardFederal Reserve is the central bank of the United States. She conducts monetary policy with various tools.a. Many central banks share similar policy objectives. What are the objectives of the Federal Reserve? b. Suppose the Federal Reserve announces a “loose” monetary policy.What has to be done, traditionally, with an open market operation? Explain with reference to the money creation processarrow_forward

- If the Bank of Canada wanted to reduce inflation, it could Select one: a. increase the reserve requirement or implement an open market sale. b. increase the reserve requirement or implement an open market purchase. c. decrease the reserve requirement or implement an open market purchase. d. decrease the reserve requirement or implement an open market sale.arrow_forwardpart Barrow_forwardWhat happens when a central bank pursues inflation targeting? A. The policy actions that central banks use to achieve the inflation target are kept secret. B. With inflation targeting, the United States would be more successful at achieving low and stable inflation. C. Many central banks achieve their inflation target at the expense of extremely high unemployment. D. The bank announces an explicit inflation target and the public is confident the bank's policy will achieve that target. thank you!!arrow_forward

- 1) https://www.econlowdown.org/resource-gallery/monetary_policy_tools 2) https://www.wsj.com/articles/zimbabwe-money-aa13a052?mod=hp_featst_pos5 3) https://news.sky.com/video/jamaican-bank-releases-reggae-song-on-inflation-12058864 please I need a short summary of these articles.arrow_forwarda. According to the Misperceptions theory, what would be the effect of an unanticipated monetary expansion shock on real interest rate (r), real output (Y), and price level (P) in the short and in the long-run? Why? Explain with details.b. Does your answer change if the shock is expected/anticipated? Why? Show how.arrow_forwardWhich of the following will most likely cause a change in the natural rate of unemployment? Select one: a. expansionary fiscal policy b. contractionary monetary policy c. contractionary monetary policy d. none of the other alternatives is correct e. expansionary monetary policy.arrow_forward

- b. Why do some people say that inflation is a tax? Who pays that tax? Who collects that tax? How does it work exactly? Does your answer depend on whether the world is best described by a general equilibrium (Classica economics) or disequilibrium (Keynesian)? c. Economists say that, in response to a wage rate increase, the overall labor supply may increase, decrease or remain unchained. Why aren't economists more certain about the consequences of something as simpl as a wage increase? d. The introduction of the ATM machine led to a period of price level increases. Why? Explain your answer intuitively. e. What is the "intertemporal labor substitution" effect (also known as the "Uber" effect)? Although you can use with a numerical example to illustrate your answer, make sure you explain it with words.arrow_forward1. What are the main reasons that the U.S. inflation surged last year? 2. What is the monetary policy the Fed (central bank of the U.S.) uses to control inflation? 3. How did the monetary policy cause the bankruptcy of Silicon Valley Bank?arrow_forwardhow inflation has caused monetary Policy to change and how? Would it be advantageous to borrow money if you expected prices to rise? Would you want a fixed-rate loan or one with an adjustable interest rate? a). List and explain the 3 tools of monetary policy discussed. Compare the rates before the pandemic, during the pandemic, and now.What tools are being used to reduce inflation? Compare all the monetary policy tools before and after inflation.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education