FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

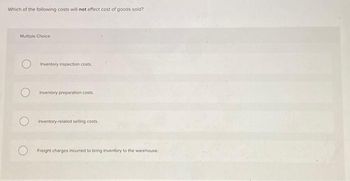

Transcribed Image Text:Which of the following costs will not affect cost of goods sold?

Multiple Choice

Inventory inspection costs.

Inventory preparation costs.

Inventory-related selling costs.

O Freight charges incurred to bring inventory to the warehouse.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I need number 3. Determine the cost assigned to ending inventory and to cost of goods sold using FIFO.arrow_forwardA merchandising business purchases goods for resale. A merchandiser makes a profit by selling goods at a price higher than the cost of the goods sold. While the underlying business transaction is straightforward, determining of the cost of the merchandise sold often requires an inventory cost flow assumption when similar units are purchased at different units costs during the period. Identify cost flow assumptions to their description: Cost Flow Assumption (choose between FIFO,LIFO, weighted average, or specific identication) Description Cost flow is the reverse order in which the costs were incurred. Cost flow is the order in which the costs were incurred. Cost flow is an average of the purchase costs. Unit cost is identified with a specific purchase Often, specification identification may not be practical, so one of the other three cost flow assumptions is assumed. The cost flow assumption can be applied under either the perpetual or periodic inventory system.arrow_forwardDiscuss the effect of absorption and marginal costing on inventory valuation and profit determination. Highlight both advantages and disadvantages of both methodsarrow_forward

- What are expenses like sales salaries expense, advertising expense, etc. called that are incurred directly in the selling of merchandise inventory? Group of answer choices administrative expenses other expenses selling expenses cost of goods soldarrow_forwardThe application of the lower of cost or market rule to inventory valuation is an example of a. the revenue realization principle b. the going concern assumption c. special industry practices d. conservatismarrow_forwardI'm having trouble finding the opening direct material inventory on the cost of goods sold (the very last one). Can you show me how to get answer?arrow_forward

- What effect would an underestimated degree of completion of ending inventory have on a.) production cost per unit, b.) equivalent units, and c.) costs transferred outarrow_forwardAcceptable methods of assigning specific costs to inventory and cost of goods sold include all of the following except: Multiple Choice LIFO method. FIFO method. Specific identification method. Weighted average method. Retail method.arrow_forwardCalculate the value of ending inventory and cost of goods soldarrow_forward

- 1. Inventory should be stated at (a) Lower of cost and fair value. (b) Lower of cost and net realizable value. (c) Lower of cost and nominal value. (d) Lower of cost and net selling price. 2. Which of the following costs of conversion cannot be included in cost of inventory? (a) Cost of direct labor. (b) Factory rent and utilities. (c) Salaries of sales staff (sales department shares the building with factory supervisor). (d) Factory overheads based on normal capacity. 3. Inventories are assets (a) Used in the production or supply of goods and services for administrative purposes. (b) Held for sale in the ordinary course of business. (c) Held for long-term capital appreciation. (d) In the process of production for such sale. (e) In the form of materials or supplies to be consumed in the production process or the rendering of services. (f) Choices b and d. (g) Choices b, d, and e. 4. The cost of inventory should not include (a) Purchase price. (b) Import duties and other taxes. (c)…arrow_forwardExplain how the retail inventory method can be made to approximate the lower of cost or market rule.arrow_forwardWhat factors might impact on the management’s selection of an inventory cost flow assumption? In your answer you need to provide explanation on what factors could impact on a manager to choose FIFO, LIFO or the average cost method. In your answer you may want to refer to issues such as the impact of various cost flow assumptions on the income statement or the statement of financial position. List four factors in your answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education