FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

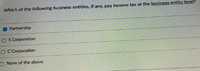

Transcribed Image Text:Which of the following business entities, if any, pay income tax at the business entity level?

Partnership

O S Corporation

O C Corporation

O None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Which of the following entities is subject to double taxation? A) S Corporation B) Sole Proprietorship CI C Corporation D) Limited Liability Partnership (LLP)arrow_forwardWhich of the following legal entities are generally classified as C corporations for tax purposes? Multiple Choice Limited liability companies. S corporations. Limited partnerships. Sole proprietorships. None of the choices is correct.arrow_forwardPartnerships: a.Are not taxable entities. b.Are taxed in the same manner as individuals. c.File tax returns on Form 1041. d.File tax returns on Form 1120.arrow_forward

- To qualify as a pass-through entity for U.S. corporate income tax, a REIT must be all of the following EXCEPT a.structured as a corporation, trust, or association. b.have transferable shares or certificates of interest. c.managed by a board of directors or trustees. d.jointly owned by less than 100 persons.arrow_forwardAll of the following persons are classified as employees under the federal income tax withholding law with the exception of a. the president of a corporation b. an officer of the federal government c. an elected official in the state government d. a first - line supervisor e. a partnerarrow_forwardIn general terms, indicate how the following separate entities are subject to the Federal income tax. a. C corporations are separate taxable entities, (but not district from/distinct from) their shareholders. b. How are partnerships taxed?Income & losses pass-through to the partners/at the partnership level/at the partnership and partner level . c. S corporations ( never/normally/rarely) incur Federal income tax liabilities. d. Fiduciary entities are subject to Federal income tax when income (exceeds expenses/ is distributed to the beneficiaries/ is retained by the entity) .arrow_forward

- The accumulated earnings tax, which is imposed on corporations for the accumulation of earnings in excess of reasonable business needs, does not apply to: a. Closely-held corporations. b. Widely-held corporations. c. Corporations subject to the personal holding company tax. d. Both "Widely-held corporations" and "Corporations subject to the personal holding company tax". e. All of these choices are correct.arrow_forward1. Establishes the tax differences between individuals and corporations in the United States. 2. Explains Form M-1 and what it is used for. 3. Explains Form 1125-A and what it is used for.arrow_forwardWhat are the advantages to a business combination filing a consolidated tax return? Considering these advantages, why do some members of a business combination file separate tax returns?arrow_forward

- Which of the following is a characteristic of a corporation?a. No income taxb. Limited liability of stockholdersc. Mutual agencyd. Both b and carrow_forwardWhich statement is incorrect? a. S corporations are treated as corporations under state law. b. S corporations are treated as partnerships for Federal income tax purposes. c. Distributions of appreciated property are taxable to the S corporation. d. All of these choices are correct.arrow_forwardhow do owners’ equity accounts in a corporation differ from those in a sole proprietorship or partnershiparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education