ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

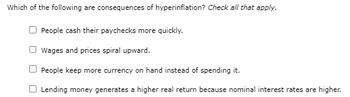

Which of the following are consequences of hyperinflation? Check all that apply.

People cash their paychecks more quickly.

Wages and prices spiral upward.

People keep more currency on hand instead of spending it.

Lending money generates a higher real return because nominal interest rates are higher.

Transcribed Image Text:Which of the following are consequences of hyperinflation? Check all that apply.

People cash their paychecks more quickly.

Wages and prices spiral upward.

People keep more currency on hand instead of spending it.

Lending money generates a higher real return because nominal interest rates are higher.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Suppose that the supply of credit cards is given by (1/200) X = q, the nominal interest rate is 0.06, real GDP is Y = 52, and the price level is P = 105. What must be the quantity of money supplied for this money market to be in equilibrium. Round your answer to the nearest whole number.arrow_forwardAn increase in nominal GDP will Multiple Choice increase the transactions demand and the total demand for money. decrease the transactions demand and the total demand for money. increase the transactions demand for money but decrease the total demand for money. decrease the transactions demand for money but increase the total demand for money.arrow_forwardConsider a simple economy that produces only loaves of bread. The table contains information on the economy's output, money supply, velocity, and price level. For example, in 2009, the money supply was $200, the price of a loaf of bread was $5, and the economy produced 400 loaves of bread. Use the information in the table and your previous answers. The money supply grew at a rate of % from 2009 to 2010 and the inflation rate (percentage change in prices) grew at a rate of % from 2009 to 2010. [Use one decimal place in your answer] 2009 2010 Quantity of Money $200 $216 Velocity of Money 10 Price Level $5.00 Quantity of Output 400 400arrow_forward

- The number of times per year each dollar is spent A. Money Supply B. Velocity C. Price Level D. Quantity of Output E. All of the abovearrow_forwardIn the monetary intertemporal model, the supply of money is determined by the government merged with the Bank of Canada. the sale of bonds by the chartered banks. Oprivate sector transactions. the Bank of Canada. foreign capital flows.arrow_forwardIf the central bank sells government securities from the private sector-money markets,other things being equal, what would the effect be on the following?The economy’s monetary base, Short-term money market interest rates, Investment, Aggregate demand, Aggregate supply, economic activity, Inflation, Unemploymentarrow_forward

- I need help with this questionarrow_forwardDiscuss what caused hyperinflation in Zimbabwe and if you think this could happen in The United States.arrow_forwardAssume GDP is currently $11,700 billion per year and the quantity of money is $650 billion. What is the velocity of money? The nation collectively holds enough money to finance how many days worth of GDP expenditurearrow_forward

- In general, when there is less competition in the banking sector ( a lower supply of firms), nominal interests rates decrease, which makes it easier for business owners to obtain a loan. inflation decreases, which is better for the economy as a whole. nominal interest rates increase, which is good for businesses. nominal interest rates increase, making it more difficult for business owners to obtain loans, which is bad for the economy as a whole.arrow_forwardRobust economy growth ships the transactions demand for money. Consequently, growth will tend to either raise our interest rate or decrease those rates. Please see which direction the rates move, and explain whyarrow_forwardAccording to the quantity theory of money, a. V and M are constant. b. V and Y are not affected by the quantity of money. c. V and P are not affected by the quantity of money. d. V and M are not affected by changes in the price level.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education