FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

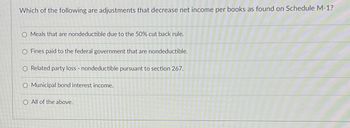

Transcribed Image Text:Which of the following are adjustments that decrease net income per books as found on Schedule M-1?

O Meals that are nondeductible due to the 50% cut back rule.

O Fines paid to the federal government that are nondeductible.

Related party loss - nondeductible pursuant to section 267.

O Municipal bond interest income.

O All of the above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- D Exercise 5-7A (Static) Which of the following statements are true about state and local income taxes? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) W S X F2 ? All states tax employee earnings. ? Some localities levy income tax on employees. State tax rates on employee earnings vary among states. ? Certain states have no personal income tax deduction. # 3 E JUL 7 80 F3 $ 4 R Q F4 % 5 U * 00 8 DII F8 I ( 9 J K CVBNM A F9 0 < ) 0 F10 L W P 4 F11 { [ = F12 ?arrow_forwardWhich of the following items is subtracted from book income to arrive at taxable income? Multiple Choice Interest received on tax-exempt bonds. Charitable contributions in excess of the 10% limit. 50% of meal expenses not provided by a restaurant.arrow_forward3arrow_forward

- E12.6 (LO 1) (Payroll Tax Entries) The payroll of YellowCard Company for September 2025 is as follows. Total payroll was $480,000, of which $110,000 is exempt from Social Security tax because it represented amounts paid in excess of $142,800 to certain employees. The amount paid to employees in excess of $7,000 (the maximum for both federal and state unemployment taxes) was $400,000. Income taxes in the amount of $80,000 were withheld, as was $9,000 in union dues. The state unemployment tax is 3.5%, but YellowCard Company is allowed a credit of 2.3% by the state for its unemployment experience. Also, assume that the current FICA tax is 7.65% on an employee's wages to $142,800 and 1.45% in excess of $142,800. The federal unemployment tax rate is 0.8% after state credit. Instructions Prepare the necessary journal entries if the wages and salaries paid and the employer payroll taxes are recorded separately.arrow_forward11.A taxpayer is claiming tax preparation expense as a legal and professional fee. They paid $430 at your office last year. The forms breakdown by cost is as follows: Form 1040- $100 Form Sch. C- $125 Form SE- $55 Form 8867- $75 Form 8863- $75 What is the correct amount that can be deducted on their Schedule C for the current year? Choose one answer. a. $280 b. $180 c. $355 d. $430arrow_forwardplease help me find the write answer for rhe ones that are wrong (red boxes) thank youarrow_forward

- The TCJA eliminated which of the following? • A) Annual Filing Season Program B) Deduction for qualified employee fringe benefits for transportation • C) Due Diligence Requirements • D) Deduction for gambling lossesarrow_forwardSection 529 college savings plans are state-sponsored. True Question 2 oo False Qualifying contributions to personal retirement accounts are subtracted as oooo adjustments to income itemized deductions exclusions tax credits Question 3 Which of the following types of taxes is deductible for federal income tax purposes? Federal income taxes Real estate property taxes Federal Social Security taxes Federal excise taxes on tiresarrow_forwardGive me correct answer with explanation.jarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education