Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

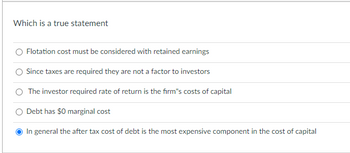

Transcribed Image Text:Which is a true statement

Flotation cost must be considered with retained earnings

Since taxes are required they are not a factor to investors

The investor required rate of return is the firm's costs of capital

O Debt has $0 marginal cost

In general the after tax cost of debt is the most expensive component in the cost of capital

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The financial manager of a firm determines the following schedules of cost of debt and cost of equity for various combinations of debt financing: Debt/Assets After-Tax Cost of Debt Cost of Equity 0 % 4 % 7 % 10 4 7 20 4 7 30 4 9 40 5 10 50 5 12 60 8 13 70 8 15 Find the optimal capital structure (that is, optimal combination of debt and equity financing). Round your answers for the capital structure to the nearest whole number and for the cost of capital to one decimal place. The optimal capital structure: % debt and % equity with a cost of capital of % Why does the cost of capital initially decline as the firm substitutes debt for equity financing? The cost of capital initially declines because the firm cost of debt is than the cost of equity. Why will the cost of funds eventually rise as the firm becomes more financially leveraged? As the firm becomes more financially leveraged and riskier, the cost of debt…arrow_forwardwhich one is correct please confirm? QUESTION 37 Which of the following statements is true concerning companies that do not pay dividends? a. The cost of equity capital can be estimated using the Capital Asset Pricing Model. b. The cost of equity capital is equal to the growth short-term rate of earnings per share. c. The dividend capitalization model can be used to determine an accurate cost of equity capital. d. None of these are correctarrow_forwardThe optimal capital structure for firms in stable industries can reasonably contain ________________ than firms in volatile industries. Select one: A. more debt B. less debt C. an equal amount of debt D. There is no relationship between the cyclical nature of an industry and optimal capital structurearrow_forward

- Which of the followings proposes that there is a tradeoff between level of borrowing and benefit of tax shields up a point after which financial distress costs start kicking in? CAPM Static capital structure theory M&M Proposition I M&M Proposition II Pecking order theory Floation cost includes Gross spread Direct expenses Indirect expenses Abnormal returns All of above Which one of the followings states that the value of a firm is unrelated to the firm's capital structure? Capital Asset Pricing Model M&M Proposition I M&M Proposition II Law of One Price Efficient Markets Hypothesisarrow_forwardSolve both with Explanationarrow_forwardWhich of the following will increase the WACC for a tax-paying company? Decrease the proportion of equity financing Decrease the proportion of debt financing Decrease the market value of the equity Increase the market value of the debtarrow_forward

- While the use of debt can lower the average cost of capital, there is a point that the debt leverage gets high enough it increases the cost of capital. Group of answer choices True Falsearrow_forwardA higher dividend payout ratio entails? A• Lower marginal cost of capital B• Higher investment opportunity C• No effect in cost of capital D• Higher marginal cost of capitalarrow_forwardCapital strucutre In this exaple i have done. Why does the cost of capital not change but the cost of equity has to changearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education