ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

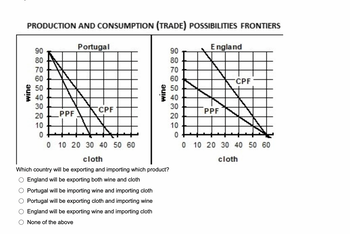

Which country will be exporting and importing which product?

A) England will be exporting both wine and cloth

B) Portugal will be importing wine and importing cloth

C) Portugal will be exporting cloth and importing wine

D) England will be exporting wine and importing cloth

E) None of the above

Transcribed Image Text:PRODUCTION AND CONSUMPTION (TRADE) POSSIBILITIES FRONTIERS

Portugal

wine

90

80

70

60

50

40

30

20

10

0

0 10 20 30 40 50 60

PPF

CPF

wine

cloth

Which country will be exporting and importing which product?

England will be exporting both wine and cloth

Portugal will be importing wine and importing cloth

Portugal will be exporting cloth and importing wine

England will be exporting wine and importing cloth

None of the above

England

90

80

70

60

50

40

30

20

10

0

0 10 20 30 40 50 60

cloth

PPF

CPF

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The small nation of Capralia has an abundant stock of Pashmina goats, a breed that yields high‑quality cashmere. Capralia's authorities are still debating whether to open their economy to international trade. The international price of cashmere is $70,000 per metric ton, and the Capralian cashmere sells for $50,000 per metric ton.arrow_forwardA tariff lowers the price of the imported good below the world price. lowers the price of the exported good below the world price. raises the price of the imported good above the world price. keeps the price of the exported good the same as the world price.arrow_forwardQ1: Using a domestic-market demand- and supply-curve graph, (a) show the impact of tariff on a small country's import price, domestic demand, domestic supply, import quantity, consumer surplus, producer surplus, government revenue, and total welfare; (b) Is the country unambiguously worse off as a result of the tariff? (c) In the same graph, show how to achieve the same import quantity with an import quota; (d) When would the tariff and the import quota lead to the same amount of welfare change? (e) How would the answers to (a) and (b) change for a large country?arrow_forward

- If Indonesia (which is a small country) imposes an import tariff on textile imports, we can conclude that:(a) The world price of textile rises, and Indonesia imports less.(b) The world price of textile stays constant, and Indonesia imports less.(c) The world price of textile falls, and Indonesia imports less.(d) The world price of textile stays constant, and Indonesia imports the same as before. Explain why.arrow_forwardVietnam has a policy of free trade in motorcycles which are sold in world markets at a price of 10,000 per motorcycle. Under free trade, Vietnam produces 100,000 motorcycles and imports 100,000 motorcycles. To provide some protection to the domestic industry, Vietnam imposes an import tariff of $1500 per motorcycle. With this tariff in place, production in Vietnam rises by 5,000 motorcycles and consumption drops by the same amount. Calculate the effects of the tariff on: a. Consumer Surplus b. Producer Surplus c. Government Revenues d. Overall Welfare e. If the tariff imposed by the Vietnamese had led to small reduction in world prices of, say, 250 dollars, how, qualitatively, would the welfare calculations (a), (b), (c) and (d) above change?arrow_forwardB1) Country A has 10 million workers and Country B has 20 million workers. Each worker in Country A can produce 2 units of wine and 4 units of fabric in a year. Each worker in Country B can produce 3 units of wine and 5 units of fabric in a year. a) Which country should import wine? Explain your answer. b) What is the range of trading prices (in terms of fabric) for wine between the two countries?arrow_forward

- A country decides to impose higher tariffs on imported goods to encourage domestic production. This policy change impacts the circular flow of income and expenditure by altering the dynamics of international trade. In this scenario, the imposition of tariffs on imports primarily:A) Acts as a leakage in the circular flowB) Functions as an injection into the circular flowC) Has no significant impact on the circular flowD) Reduces government expenditure in the circular flow Note:- Please avoid using ChatGPT and refrain from providing handwritten solutions; otherwise, I will definitely give a downvote. Also, be mindful of plagiarism.Answer completely and accurate answer.Rest assured, you will receive an upvote if the answer is accurate.arrow_forwardWhich statement BEST reflects the difference between tariffs and quotas? Tariffs raise prices on imports, while quotas set limits on imports Tariffs raise prices on exports, while quotas set limits on exports Tariffs raise prices on imports, while quotas set limits on exports Tariffs raise prices on exports, while quotas set limits on importsarrow_forwardIf Bangladesh is open to international trade of wheat without any restrictions, it will import the full value for your answer, accounting for the horizontal axis units.) Suppose the Bangladeshi government wants to reduce imports to exactly 200,000 bushels of wheat to help domestic producers. A tariff of S per bushel will achieve this. A tariff set at this level would raise $ bushels of wheat. (Note: Be sure to enter in revenue for the Bangladeshi government.arrow_forward

- Which of the following best explains the concept of "Comparative Advantage" in international trade? a) A country should produce goods in which it has an absolute advantage and trade for those where it does not. b) A country should only export goods and import nothing to maintain a positive trade balance. c) A country should specialize in the production of goods for which it has the lowest opportunity cost compared to other countries. d) A country should diversify its production across various sectors to avoid dependence on a single export commodity.arrow_forwardA small country imports T-shirts. With free trade at a world price of $10, domestic production is 10 million T-shirts and domestic consumption is 42 million T-shirts. The country's government now decides to impose a quota to limit T-shirt imports to 20 million per year. With the import quota in place, the domestic price rises to $12 per T- shirt and domestic production rises to 15 million T-shirts per year. The quota on T- shirts causes domestic consumers to A) gain $7 million. B) lose $7 million. C) lose $70 million. D) lose $77 millionarrow_forwardAll of the following statements about import tariffs are true except Group of answer choices they result in countries selling the product at a lower price to domestic consumers they reduce the volume of trade and the gains from trade they limit specialization and the division of labor they yield revenue for the government that levies tariffsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education