FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

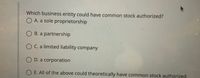

Transcribed Image Text:**Question:**

Which business entity could have common stock authorized?

**Options:**

- A. a sole proprietorship

- B. a partnership

- C. a limited liability company

- D. a corporation

- E. All of the above could theoretically have common stock authorized

**Explanation:**

This multiple-choice question aims to identify which type of business entity can issue common stock. Generally, common stock is associated with corporations. A brief explanation of each option is useful to understand why one is more applicable:

- **Sole Proprietorship:** An individual-owned business where stock is not issued.

- **Partnership:** A business owned by two or more people, typically not issuing stock.

- **Limited Liability Company (LLC):** Can have members but does not issue traditional stock like a corporation.

- **Corporation:** A business entity that can issue stock to represent ownership shares.

- **All of the above:** This option suggests that theoretically, these entities could issue stocks, which is not typical in practice.

Expert Solution

arrow_forward

Information

When a group of people with a shared objective form a corporation, it is known as a corporation.

Such a collection of people owns common stock, which is a type of company.The term "corporation" refers to legal entity . Corporations have all of the same rights and responsibilities as people. Corporations can acquire assets in their own name, engage into contracts, sell their own assets and shares, and so on. One of the most important features of a company is that it has limited liability. Shareholders are the company's owners.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- What type of Partnership as a business formation would be best suited for a "Silent Partner" (someone who contributes capital to a company but does not participate whatsoever in day to day operations) O General Partnership O C Corp O Limited Partnership O S Corparrow_forwardPlease help solvearrow_forwardWhat are the unique financial reporting implications of the Partnership entity in comparison with the Proprietorship and Corporate structures? How does the closing process differ for the Partnership?arrow_forward

- Which of the following can be eligible shareholders in an S Corporation? O Partnership. A Resident Alien. O Any Trust. O Corporations.arrow_forwardA limited partnership is a O a. Domestic Limited partnership O b. sole proprietorship O c. limited liability company O d.general partnership in the state in which it is organizedarrow_forwardhow do owners’ equity accounts in a corporation differ from those in a sole proprietorship or partnershiparrow_forward

- Which of the following organization forms accounts for the greatest number of firms? O A. Limited partnership OB. Sole proprietorship O C. "C" corporation O D. "S" corporationarrow_forwardMeredith had always dreamed about starting her own publishing company. She talked about it constantly. Her family figured she probably would. It began at the age of six when Meredith created a newsletter which she distributed to her classmates each week. She charged them one penny per copy. Since her customers were only six years old, she often had a hard time collecting payment. Fortunately, she had an older brother Thomas who was quite persuasive. He became her debt collector. About five years later, Meredith quit the newsletter and began writing articles for the school newsletter. She was the youngest journalist the school had ever had. Meredith became fairly well known in the local area after she uncovered a story about corruption in the high school student council. It seemed that the student council had been bribed by teachers with candy bars, pizza, and photos of puppy dogs. In exchange, the student council was supposed to implement policies the teachers wanted implemented. In…arrow_forwardWho is liable for a corporation's debts and obligations? OA. the limited partners OB. the general partners OC. the corporation OD. the registered agent OE. the shareholdersarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education