Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

GeoWorld Systems uses a subset of the following questions during the interview process for new engineers. For each of the following cases, determine if “the project” or “do nothing” is preferred. The value of MARR in each case is 14%.

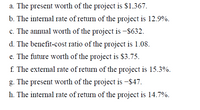

Transcribed Image Text:a. The present worth of the project is $1,367.

b. The internal rate of return of the project is 12.9%.

c. The annual worth of the project is -$632.

d. The benefit-cost ratio of the project is 1.08.

e. The future worth of the project is $3.75.

f. The external rate of return of the project is 15.3%.

g. The present worth of the project is -$47.

h. The internal rate of return of the project is 14.7%.

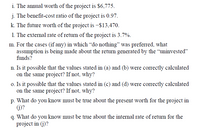

Transcribed Image Text:i. The annual worth of the project is $6,775.

j. The benefit-cost ratio of the project is 0.97.

k. The future worth of the project is –$13,470.

1. The external rate of return of the project is 3.7%.

m. For the cases (if any) in which “do nothing" was preferred, what

assumption is being made about the return generated by the "uninvested"

funds?

n. Is it possible that the values stated in (a) and (b) were correctly calculated

on the same project? If not, why?

o. Is it possible that the values stated in (c) and (d) were correctly calculated

on the same project? If not, why?

p. What do you know must be true about the present worth for the project in

(j)?

q. What do you know must be true about the internal rate of return for the

project in (j)?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Where do nothing was preferred what assumption is being made about the return generated by the univested funds?

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Where do nothing was preferred what assumption is being made about the return generated by the univested funds?

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Ned Thompson Labs performs tests on superalloys, titanium, aluminum, and most metals. Tests on metal composites that rely upon scanning electron microscope results can be subcontracted or the labs can purchase new equipment. Evaluate the sensitivity of the economic decision to purchase the equipment over a range of ±20% (in 10% increments)of the estimates for P, AOC, R, n, and MARR (range on MARR is 12% to 18%). Use the AW method and plot the results on a sensitivity graph. For which parameter(s) is the AW most sensitive? least sensitive? First cost, P = $-180,000 Salvage, S = $20,000 Life, n = 10 years Annual operating cost, AOC=$-30,000 per year Annual revenue, R = $70,000 per year MARR = 15% per yeararrow_forwardCelebrity Food is evaluating the kale crisper project. During year 1, the kale crisper project is expected to have relevant revenue of $400,000, relevant variable costs of $125,000, and relevant depreciation of $40,000. In addition, Celebrity Food would have one source of fixed costs associated with the kale crisper project. Celebrity Food just signed a deal with Lights Camera Action to develop an advertising campaign for use in the project. The terms of the deal require Celebrity Food to pay Lights Camera Action either $80,000 in 1 year if the project is pursued or $110,000 in 1 year if the project is not pursued. Relevant net income for the kale crisper project in year 1 is expected to be $200,000. calculate is the tax rate expected to be in year 1?arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- 6. Fabulous Fabricators needs to decide how to allocate space in its production facility this year. It is considering the following contracts: a. What are the profitability indexes of the projects? b. What should Fabulous Fabricators do? **round to two decimal places**arrow_forwardABC Corporation has hired you to evaluate a new FOUR year project for the firm. The project will require the purchase of a $843,200.00 work cell. Further, it will cost the firm $51,700.00 to get the work cell delivered and installed. The work cell will be straight-line depreciated to zero with a 20-year useful life. The project will require new employees to be trained at a cost of $59,100.00. The project will also use a piece of equipment the firm already owns. The equipment has been fully depreciated, but has a market value of $5,200.00. Finally, the firm will invest $10,800.00 in net working capital to ensure the project has sufficient resources to be successful. The project will generate annual sales of $917,000.00 with expenses estimated at 38.00% of sales. Net working capital will be held constant throughout the project. The tax rate is 40.00%. The work cell is estimated to have a market value of $489,000.00 at the end of the fourth year. The firm expects to reclaim 85.00% of the…arrow_forwardBased on what was reviewed in class, please submit a BOE analysis for the multi tenant retail center based on the information below. Please determine the Net Operating Income of this property. Also, what price would you pay for this property, if you wanted to achieve a 5% Cap Rate (Capitalization Rate)? NOTE: Common Area Maintenance (CAM) paid by tenants are $0.67 Per Square Foot, Per Month. Assume 5% Vacancy Rate. BOE Analysis - Assignment.pngarrow_forward

- The Chief Operations Officer (COO) of a manufacturing firm recommends one of the manufacturing sites to undergo a process improvement initiative. He claims that this project will enable the company to realize a net savings of at least $3.25 Mln. The Chief Financial Officer (CFO) of the company tasked you to conduct a financial analysis to verify the claims of the COO. After performing cost analysis, you estimated that the project will require an initial investment of $2 Mln today and $1 Mln in Year 1. Afterwards, the initiative will yield an annual cost savings of $850k from Year 2 to Year 10. You assume that these cost savings are realized at the end of each year. (a) Suppose that you use a discount rate of 5%. Will the resulting net savings support the claim of the COO? (b) Determine the Internal Rate of Return (IRR) of the process improvement initiative. (c) Show the NPV profile of the project.arrow_forwardThe production manager on the Ofon Phase 2 offshore platform operated by Total S.A. must purchase specialized environmental equipment or an equivalent service. The first cost is $250,000 with an AOC of $66,000. The manager has let it be known that he does not care about the salvage value because he thinks it will make no difference in the decision-making process. His supervisor estimates the salvage might be as high as $100,000 or as low as $10,000 in 3 years, at which time the equipment will be unnecessary. Alternatively, a subcontractor can provide the service for $165,000 per year. The total offshore project MARR is 13% per year. Determine if the decision to buy the equipment is sensitive to the salvage value. The annual worth of high salvage value is $______________ 142,525 incorrect.. The annual worth of low salvage value is $_______________ 168,940 incorrect.. Decision is sensitive…arrow_forwardKindly help me solve this problem using Excel. Have to calculate the payback period for the project, calculate the NPV for the project and calculate the IRR for the project.arrow_forward

- You are a manager at Northern Fibre, which is considering expanding its operations in synthetic fibre manufacturing. Your boss comes into your office, drops a consultant's report on your desk, and complains, "We owe these consultants $1.5 million for this report, and I am not sure their analysis makes sense. Before we spend the $17 million on new equipment needed for this project, look it over and give me your opinion." You open the report and find the following estimates (in millions of dollars): Sales revenue - Cost of goods sold = Gross profit - General, sales, and administrative expenses - Depreciation = Net operating income 1 2 28.000 28.000 16.800 16.800 11.200 11.200 1.360 1.360 1.700 1.700 8.1400 8.1400 9 28.000 16.800 11.200 1.360 1.700 8.1400 10 28.000 16.800 11.200 1.360 1.700 8.1400 b. If the cost of capital for this project is 9%, what is your estimate of the value of the new project? Value of project = $ million (Round to three decimal places.)arrow_forwardYou are an employee of University Consultants, Limited, and have been given the following assignment. You are to present an investment analysis of a small retail income-producing property for sale to a potential investor. The asking price for the property is $1,360,000; rents are estimated at $174,080 during the first year and are expected to grow at 2.5 percent per year thereafter. Vacancies and collection losses are expected to be 10 percent of rents. Operating expenses will be 35 percent of effective gross income. A fully amortizing 70 percent loan can be obtained at 6 percent interest for 30 years (total annual payments will be monthly payments × 12). The property is expected to appreciate in value at 3 percent per year and is expected to be owned for five years and then sold. Required: a. What is the first-year debt coverage ratio? b. What is the terminal capitalization rate? c. What is the investor’s expected before-tax internal rate of return on equity invested (BTIRR)? d.…arrow_forwardAyayai Inc., a manufacturer of steel school lockers, plans to purchase a new punch press for use in its manufacturing process. After contacting the appropriate vendors, the purchasing department received differing terms and options from each vendor. The Engineering Department has determined that each vendor's punch press is substantially identical and each has a useful life of 20 years. In addition, Engineering has estimated that required year-end maintenance costs will be $1,020 per year for the first 5 years, $2,020 per year for the next 10 years, and $3,020 per year for the last 5 years. Following is each vendor's sales package. Vendor A: $51,520 cash at time of delivery and 10 year-end payments of $19.750 each. Vendor A offers all its customers the right to purchase at the time of sale a separate 20-year maintenance service contract, under which Vendor A will perform all year-end maintenance at a one-time initial cost of $10,170. Vendor B: Forty semiannual payments of $9,780 each,…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education