Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

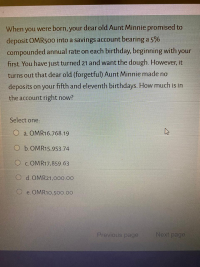

Transcribed Image Text:When you were born, your dear old Aunt Minnie promised to

deposit OMR500 into a savings account bearing a 5%

compounded annual rate on each birthday, beginning with your

first. You have just turned 21 and want the dough. However, it

turns out that dear old (forgetful) Aunt Minnie made no

deposits on your fifth and eleventh birthdays. How much is in

the account right now?

Select one:

O à. OMR16,768.19

O b.OMR15,953.74

O c. OMR17,859.63

O d. OMR21,000.00

e. OMR10,500.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 10. Kristine has $5,000 in an account today that pays 3% interest rate. Two years from now she withdraws $1,000 from that account to buy a laptop. How much will she have in this account in 6 years if she does not make any other deposits or withdrawals? Assume annual compounding. a. $4,844.75 b. $7,095.77 c. $4,776.21 d. $7,164.31 e. $4,970.26 11. Your grandaunt wants to buy an (ordinary) annuity that will pay her cost of living of $70,000 per year for 20 years. If the quoted interest rate today is 5% and the annuity compounds monthly, how much does this annuity cost? a. $872,354.72 b. $865,404.52 c. $883,897.66 d. $863,824.15 12. After graduation, you get a great job. You budget $1,000 per month towards housing. You'd like to buy a house. Assume that the interest rate = 4% for a 30-year mortgage. a. How much can you borrow? i. $209,461.24 ii. $207,504.40 iii. $694,049.40 iv. $24,999.98 b. Eight years into the mortgage, your company decides to relocate you to Hawaii. How much must you…arrow_forwardYou have collected $8,342 Your banker states that if you deposit these funds in her institution they will accumulate to $16,786 In twelve years. What is the implied rate that she is paying on this deposit? 50% 12% 5% 6%arrow_forwardOn the day you were born, your parents opened than the amount deposited in the previous year Immediately after your parents make the deposit on your 18th birthday, the amount of money in your savings account will be closest to which of the following? OA $80,839 OB $27,958 OC. $99,002 a college savings account with an initial deposit of $2.200 On every one of your birthdays since, your parents have made an additional deposit that is 3% larger The account eams 6.7% interest annually OD $30,000 OE $29,050 The deposit made on your 18th birthday will be the final deposit made into the account You plan on using the balance in the account to fund your college education You will be attending a 4-year institution and you will assume that tuition costs will remain constant over the next four years. If the first annual tution payment wit be made on your 19th birthday, what is the maximum annual tabon expense that the balance in your account can sustain if you plan on attending college for four…arrow_forward

- f1arrow_forwardWhen you were born, your grandparents put $5,000 in to a money market account to help with your college education. The bank gave them a guaranteed interest rate of 6% per year until you turned 18. How much money will be in the account on your 18th birthday if you never withdraw any money until that day? $11,417.20 $54,138.00 $1751.50 $14,271.50arrow_forward3. You are purchasing an annuity that will pay you 15,000 a year for 5 years, beginning in year 20. The rate of return on the annuity is 3.5%. What are you going to pay for the annuity today? colqmsx3 le охолова 4. You are purchasing a car from your grandparents. You agree to pay them $2000 today and $2000 per year for the next 3 years. If you assume an interest rate of 2%, what is the value of the car? noillum S.So undarrow_forward

- solve question carrow_forwardIt's the first day of the year and you currently have $3,500 in the bank. You plan to deposit $200 at the end of every year for the next 56 years, with the first payment made 1 year from now (payments from t=1 to t=56 inclusive). If bank interest rates are 1% pa, how much money will be in your bank account a moment after making your last deposit in 56 years? Question 3 Select one: a. $6,110.33 b. $14,654.33 c. $14,700 d. $21,026.53 e. $21,236.8arrow_forwardYour grandfather put some money in an account for you on the day you were born. You are now 16 years old and are allowed to withdraw the money for the first time. The account currently has $5,311 in it and pays an 11% interest rate. a. How much money would be in the account if you left the money there until your 25th birthday? b. What if you left the money until your 65th birthday? c. How much money did your grandfather originally put in the account? a. How much money would be in the account if you left the money there until your 25th birthday? If you left the money there until your 25th birthday, the amount in the account would be $ nearest cent.) (Round to thearrow_forward

- If you want to have $23,000 for a down payment for a house in six years, what amount would you need to deposit today? Assume that your money will earn 3 percent. Use the TVM keys on your calculator ... NOT the tables in the book Enter your answer as a negative value in the form: -$nn,nnn.nn Numeric Response 19,262.13 Xarrow_forwardProblem 3: Your parents deposit $1000 in your bank account paying 5% per year. What would be the balance in your account after 10 years?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education