FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

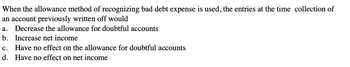

Transcribed Image Text:When the allowance method of recognizing bad debt expense is used, the entries at the time collection of

an account previously written off would

a. Decrease the allowance for doubtful accounts

b. Increase net income

c. Have no effect on the allowance for doubtful accounts

d.

Have no effect on net income

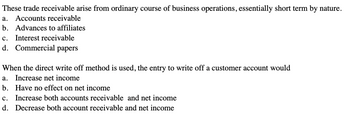

Transcribed Image Text:These trade receivable arise from ordinary course of business operations, essentially short term by nature.

a. Accounts receivable

b. Advances to affiliates

c. Interest receivable

d. Commercial papers

When the direct write off method is used, the entry to write off a customer account would

a. Increase net income

b.

Have no effect on net income

c. Increase both accounts receivable and net income

d. Decrease both account receivable and net income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which of the following is not an accurate description of the Allowance for Doubtful Accounts? Multiple Choice The account is a contra account. The account is a liability. The amount of the Allowance for Doubtful Accounts decreases the net realizable value of a company's receivables. The account is increased by an estimate of uncollectible accounts expense.arrow_forwardIf CBA Failed to meet earning expectations because Loan Impairment expense was Higher than expected, the ERC is likely to be? A. Small, as imperfections are 'fictitious accounting' B. Big, as markets dislike impairments more than other forms of expenses C. Small, because impairment represents once off expense D. Very large, because loan impressions account for a significant portion of the revenuearrow_forwardWhat does deferred revenue generally represent on the balance sheet? Amounts that have been invoiced to a customer but not yet recognized as revenue Unapplied customer payments Projected future revenues that have not been invoiced Refunds due to customersarrow_forward

- what are the most significant differences between uncollectible account expense and allowance for uncollectible accounts?arrow_forwardQuestion 2arrow_forwardWhen the amount of rebate on bills discounted shown in the adjustments, then it has to be: a. Deducted from discounts received on bills and shown in other liabilities b. Deducted from discounts on bills purchased and shown in fixed assets c. Deducted from discounts received on bills and shown in other assets d. Added to discounts received on bills and shown in other liabilitiesarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education