Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

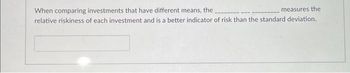

Transcribed Image Text:When comparing investments that have different means, the

measures the

relative riskiness of each investment and is a better indicator of risk than the standard deviation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- discuss the importance of considering risk when analyzing investments?arrow_forwardIn choosing where to invest, return and risk for an investment must be compared. It is not sufficient to choose an investment based only on return without taking risk into consideration. There are two methods or measures that compare return and risk. State these two methods, the formula for each and the criteria used in evaluating alternative investment of each method.arrow_forwardThe profitability index is another method to evaluate capital investments. If you are trying to compare investments of different sizes, why is the profitability index a better way to do this when compared to the net present value method?arrow_forward

- An investment requires a total return that comprises: O a real rate of return and compensation for inflation. a real rate of return, compensation for inflation, and a risk premium. compensation for inflation and a risk premium. a real rate of return, compensation for inflation, a risk premium, and compensation for time and effort devoted to researching alternative investments. None of the abovearrow_forwardWhat does Jensen's alpha measure? a. An investor's reward in proportion to their assumption of systematic risk b. The abnormal return of an asset, defined as the degree to which its actual return exceeds that predicted by the capital asset pricing model c. The degree to which diversifiable risk is eliminated d. How much reward an investor is getting for each unit of risk assumedarrow_forwardAccording to modern portfolio theory, pair-wise covariance is more important to total portfolio risk than individual security variance. True or Falsearrow_forward

- How is CAPM, Sharpe ratio, Treynor measures and Jensen’s Alpha used to Evaluate asset returns?arrow_forwardAn investment with a high return is likely to be high riskA. TrueB. Falsearrow_forward2. How would you describe the correlation between risk and return in investments, and what are the various types of income that investors consider from their standpoint?arrow_forward

- Which are the different assets that have the potential to be combined efficiently in a portfolio that will provide an optimal risk-return relationship for investors?arrow_forwardThe standard deviation of a portfolio is simply the weighted average of the standard deviations for the individual assets within the portfolio. Group of answer choices True Falsearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education