ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

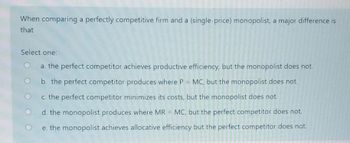

Transcribed Image Text:When comparing a perfectly competitive firm and a (single-price) monopolist, a major difference is

that

Select one:

a. the perfect competitor achieves productive efficiency, but the monopolist does not.

b. the perfect competitor produces where P = MC, but the monopolist does not.

c. the perfect competitor minimizes its costs, but the monopolist does not.

d. the monopolist produces where MR = MC, but the perfect competitor does not.

e. the monopolist achieves allocative efficiency but the perfect competitor does not.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- How does the monopoly quantity (assuming no price discrimination) compare to the competitive quantity? Assume normally shaped demand (decreasing, not completely elastic or inelastic ) a.The monopoly quantity is higher b.The monopoly quantity is lower c.There is not enough information provided to be sure. d.The monopoly quantity is the same. Which one?arrow_forwardAs long as _________ exist, a monopolist can earn positive profits in the long run A.Entry barriers B.Maximum prices C.Brandsarrow_forwardA monopolist is able to maintain into the long run primarily because a. barriers to entry exist b. of collusive behavior c. of mutual interdependence d. of price taking behavior e. of product differentiationarrow_forward

- Q20 With regard to price discrimination, we can generally say that a monopolist practicing perfect price discrimination _____ a single-price monopolist in the same market. a. Produces the same output level and charges the same price as. b. Produces a lower level of output compared to. c. Generates more consumer surplus than. d. Generates a more efficient outcome for society as a whole compared to. e. Has the same effects on consumer welfare as.arrow_forwardWhat is true about the monopoly's marginal revenue? Assume no price discrimination please (just one price can be used ) a.Marginal revenue is lower than the price (except for the first unit), because selling more requires the monopoly to discount the former units as well b. Marginal revenue is equal to price c.Marginal revenue is higher than price d.None of the other answers is correct Which one?arrow_forwardWhat is the answer and why?arrow_forward

- Which of the following statements is false? Select one: a. Ceteris paribus, a monopolist charges the same price as a perfect competitor. b. All of the other statements are false. c. The monopolist never takes a loss. d. All monopolies are created by the government.arrow_forward1. Using a graph, show a situation in which a monopolist is incurring short-run losses. Explain how this is possible. 2. Julee has estimated the demand and marginal revenue for her product. They are P = 100 - 2Q (quantity) and MR = 100 - 4Q, respectively. She also experiences constant marginal cost of $16. a. Does Julee have any market power? How can you tell? b. What is Julee’s profit-maximizing quantity? c. What price should Julee charge at that profit-maximizing quantity? 3. Explain a situation in which, when holding costs constant, a monopolist that was earning economic profits in the past can later incur an economic loss.arrow_forwardQ9arrow_forward

- Question :- A monopolist faces an inverse demand curve given by P= 800 - 2Q and a cost curve given by C(Q)= 40Q + 3Q2. If this firm practices 1st degree price discrimination, it will earn _______ in surplus. Select one: a. $36,100 b. None of these. c. $28,880 d. $0arrow_forwardSuppose there are 5 types of consumers: Type A. Type B. Type C. Type D, and Type E. There are 3,000 of each type. Two software products are sold by a monopolist: spreadsheets and word processing. Assume the marginal cost of production is $0. Consumer Type A B C D E Number 3,000 3.000 3,000 3.000 3,000 Spreadsheet 800 300 200 100 0 b. What is profit at this pricing policy? $ Willingness to Pay Word Processor Instructions: Round your answers to the nearest whole number. a. What will be the profit-maximizing bundle price? $ 0 100 200 300 800 Both 800 400 400 400 800 c. How will profit from this pricing policy compare to profit under independent pricing of the two goods? When pricing independently, the profit-maximizing price for spreadsheets is $ processing is $ d. What is profit under independent pricing? $ and the profit-maximizing price for wordarrow_forward3. Suppose a software monopolist faces two markets for its software, students and professionals. The demand curve of professionals is given by Qp = 200-2Pp and the demand curve by students is given by Qs = 150 - 3Ps. The firm's cost function is C(Q) = 400+5Q. (a) If the firm can price discriminate, what price should it charge in each market to maximize profits? How much profit does it earn? (b) If the firm cannot price discriminate, what price should it charge? Verify that it sells to both markets at this price. How much profit does it earn? Hint: If the firm cannot price discriminate, this means it must treat the two markets as a single combined market.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education