EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Please double-check that this is the correct answer. Thank you.

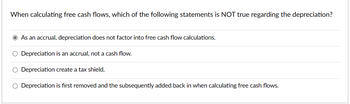

Transcribed Image Text:When calculating free cash flows, which of the following statements is NOT true regarding the depreciation?

As an accrual, depreciation does not factor into free cash flow calculations.

O Depreciation is an accrual, not a cash flow.

O Depreciation create a tax shield.

O Depreciation is first removed and the subsequently added back in when calculating free cash flows.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Depreciation is incorporated in cash flows because it: A. Is unavoidable cost B. Is a cash flow C. Involves an outflow D. Reduces tax liabilityarrow_forwardDepreciation has cash flow consequences only because Blank______. Multiple choice question. it increases the gross profit it decreases the gross profit it increases the tax bill it decreases the tax billarrow_forwardWhich sentence is incorrect? Select one: a. Depreciation is not the actual change in the value of the asset. b. Accumulated Depreciation account has effects on the cash flow statement. c. Accumulated Depreciation is called a contra asset account. d. Depreciation is the process of allocating the cost of an asset to expense, not a valuation process.arrow_forward

- Select all that are true with respect to depreciation. Group of answer choices Depreciation is a cash flow outflow at the time it is recorded in the financial statements Depreciation itself is not a cash flow Accounting depreciation impacts cash flow, Tax depreciation does not Accounting depreciation does not impact cash flow, Tax depreciation does impact cash flow The depreciation tax shield is a relevant cash flow for decision makingarrow_forwardIn the Statement of Cash Flows, depreciation is ignored because it is a non cash expense. Group of answer choices True Falsearrow_forwardhow can depreciation be a cash flow?arrow_forward

- Depreciation is needed only for computing income taxes. True or false?arrow_forwardAssuming that there are no income taxes, which of the following is correct concerning depreciation? Select one: a. Depreciation reduces net income but does not change cash from operations. b. Depreciation provides less cash from operations than would have been available without the depreciation. c. Depreciation builds a cash reserve to fund the replacement of plant, property and equipment d. None of the other choices is correct. e. Depreciation increases cash from operations and decreases net income.arrow_forwardWhy is Cash Flow affected by depreciation.arrow_forward

- ⦁ The reason that depreciation is a source of cash inflow is because A. it is a tax-deductible non-cash expense.B. it supplies cash for future asset purchases.C. it is a tax-deductible cash expense.D. it is a taxable expense.arrow_forwardDemonstrates the difference between depreciation costs as expenses and the cash flow generated by the purchase of a fixed asset? Give an example?arrow_forwardWhich of the following is not a factor in selecting a depreciation method? a. salvage valueb. repair and maintenance costsc. Inflationd. the risk associated with the cash flows from the assetarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College