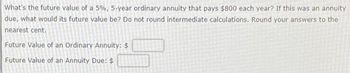

The future value of an ordinary annuity and an annuity due are two important financial concepts used to determine the value of a series of payments made at regular intervals over a specified period of time.

An ordinary annuity is a series of equal payments made at the end of each period, whereas an annuity due is a series of equal payments made at the beginning of each period.

The future value of an ordinary annuity can be calculated using the following formula:

where FV is the future value of the annuity, A is the payment amount, r is the interest rate, and n is the number of periods.

The future value of an annuity due can be calculated using the following formula:

where the same variables are used as in the ordinary annuity formula, but the future value is multiplied by (1 + r) to account for the payments being made at the beginning of each period, rather than at the end.

In both cases, the future value of the annuity will be higher than the sum of the individual payments, due to the compounding effect of interest over time.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

- What's the interest rate of a 8-year, annual $3,600 annuity with present value of $20,000? (Use a time value of money calculator or a spreadsheet. Round your answer to 2 decimal places.) Annuity interest rate %arrow_forwardUse a calculator to evaluate an ordinary annuity formula for m, r, and t (respectively). Assume monthly payments. (Round your answer to the nearest cent.) $20; 4%; 30 yr A = $arrow_forwardWhat is the future value of a 6%, 5-year ordinary annuity that pays $450 each year? Do not round intermediate calculations. Round your answer to the nearest cent. If this were an annuity due, what would its future value be? Do not round intermediate calculations. Round your answer to the nearest centarrow_forward

- If the present value of an ordinary, 6-year annuity is $8,800 and interest rates are 9.5 percent, what’s the present value of the same annuity due? (Round your answer to 2 decimal places.) PV = $_______.__arrow_forwardIf the future value of an ordinary, 7-year annuity is $9,900 and interest rates are 9.0 percent, what’s the future value of the same annuity due?arrow_forwardIf you start making $60 monthly contributions today and continue them for five years, what's their future value if the compounding rate is 10.25 percent APR? What is the present value of this annuity? Note: Do not round intermediate calculations and round your final answers to 2 decimal places.arrow_forward

- If the future value of an ordinary, 6-year annuity is $8,500 and interest rates are 9.5 percent, what's the future value of the same annuity due? (Round your answer to 2 decimal places.)arrow_forwardFind the future value of an annuity due of $650 semiannually for four years at 8% annual interest compounded semiannually. What is the total investment? What is the interest? E Click the icon to view the Future Value of $1.00 Ordinary Annuity table. The future value is $. (Round to the nearest cent as needed.)arrow_forwardWhat is the future value of a 7%, 5-year ordinary annuity that pays $650 each year? Do not round intermediate calculations. Round your answer to the nearest cent. $ If this were an annuity due, what would its future value be? Do not round intermediate calculations. Round your answer to the nearest cent. $arrow_forward

- Complete the following for the present value of an ordinary annuity. (Use Table 13.2.) Note: Do not round intermediate calculations. Round your answer to the nearest cent. Amount of annuity expected $ 750 Payment Annually Time 4 years Interest rate 6 % Present value (amount needed now to invest to receive annuity)arrow_forward(Present value of an annuity due) Determine the present value of an annuity due of $5,000 per year for 8 years discounted back to the present at an annual rate of 14 percent. What would be the present value of this annuity due if it were discounted at an annual rate of 19 percent? a. If the annual discount rate is 14 percent, the present value of the annuity due is $ (Round to the nearest cent.)arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education