Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN: 9781285595047

Author: Weil

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

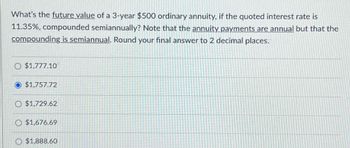

Transcribed Image Text:What's the future value of a 3-year $500 ordinary annuity, if the quoted interest rate is

11.35%, compounded semiannually? Note that the annuity payments are annual but that the

compounding is semiannual. Round your final answer to 2 decimal places.

O $1,777.10

$1,757.72

O $1,729.62

$1,676.69

$1,888.60

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Value of an Annuity Using the appropriate tables, solve each of the following. Required: 1. Beginning December 31, 2020, 5 equal withdrawals are to be made. Determine the equal annual withdrawals if 30,000 is invested at 10% interest compounded annually on December 31, 2019. 2. Ten payments of 3,000 are due at annual intervals beginning June 30, 2020. What amount will be accepted in cancellation of this series of payments on June 30, 2019, assuming a discount rate of 14% compounded annually? 3. Ten payments of 2,000 are due at annual intervals beginning December 31, 2019. What amount will be accepted in cancellation of this series of payments on January 1, 2019, assuming a discount rate of 12% compounded annually?arrow_forwardYou want to invest $8,000 at an annual Interest rate of 8% that compounds annually for 12 years. Which table will help you determine the value of your account at the end of 12 years? A. future value of one dollar ($1) B. present value of one dollar ($1) C. future value of an ordinary annuity D. present value of an ordinary annuityarrow_forwardWhat is the present value of a 8-year ordinary annuity with annual payments of $523, evaluated at a 4 percent interest rate? Round your answer to 2 decimal placesarrow_forward

- What is the present value of a 3-year annuity of $180 if the discount rate is 7%? . What is the present value of the annuity in (a) if you have to wait an additional year for the first payment? (Do not round intermediate calculations. Round your final answer to 2 decimal places.)arrow_forwardWhat is the future value of a 5-year ordinary annuity with annual payments of $417, evaluated at a 7 percent interest rate? Round answer to 2 decimal placesarrow_forwardWhat's the present value of a $890 annuity payment over six years if interest rates are 10 percent? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Present valuearrow_forward

- What is the present value of an annuity that pays $58 per year for 13 years and an additional $1,000 with the final payment? Use a nominal rate of 7.23%. $1,039 $946 O $882 O $990 O $873arrow_forwardFind the future value of an annuity due of $1,500 semiannually for six years at 7% annual interest compounded semiannually. What is the total investment? What is the interest? E Click the icon to view the Future Value of $1.00 Ordinary Annuity table. The future value is $. (Round to the nearest cent as needed.)arrow_forwardWhat is the present value of a 3-year annuity of $120 if the discount rate is 7%? (Do not round intermediate calculations. Round your answer to 2 decimal places.) What is the present value of the annuity in (a) if you have to wait an additional year for the first payment? (Do not round intermediate calculations. Round your final answer to 2 decimal places.)arrow_forward

- What is the value today of a 15-year annuity that pays $630 per year? The annuity's first payment occurs six years from today. The discount interest rate is 11 percent for Years 1 through 5 and 13 percent thereafter. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Present valuearrow_forwardAn annuity of 1, issued at age 35, is payable at the beginning of each year until age 65. The annuity payments are certain for the first 15 years. You are given: ä 15 ä = 11.94 å 35:15| 11.62 ä35 = 21.02 19.60 30 ä 35:30] 18.13 ä50 = 15.66 ä65 = 9.65 Calculate the expected present value of the annuity. A Less than 18.00 B At least 18.00, but less than 18.50 C At least 18.50, but less than 19.00arrow_forwardWhat is the future value of an ordinary annuity that pays $4,600 per year for 4 years? The appropriate interest rate is 7 percent. Answers: a. $10,000 b. $6,452 c. $20,423.74 d. $4,657 An investment will pay $600 at the end of each of the next 2 years, $700 at the end of Year 3, and $1,000 at the end of Year 4. What is its present value if other investments of equal risk earn 6 percent annually? Answers: a. $1,134 b. $5,324 c. $2,345.50 d. $2,569.77 *PLEASE SHOW ALL STEPS! CANNOT USE EXCEL TO SOLVE! CAN USE CALCULATOR FUNCTIONS!!arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning