FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

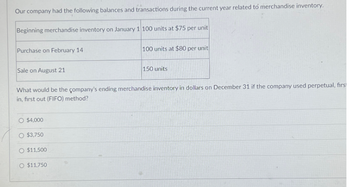

Transcribed Image Text:Our company had the following balances and transactions during the current year related to merchandise inventory.

Beginning merchandise inventory on January 1 100 units at $75 per unit

Purchase on February 14

Sale on August 21

$4,000

What would be the company's ending merchandise inventory in dollars on December 31 if the company used perpetual, first

in, first out (FIFO) method?

O $3,750

$11,500

100 units at $80 per unit

O $11.750

150 units

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ABC co. has the following data for the month ended January 31, 2021. ABC uses periodic inventory system: Date 1/1 Beginning Inventory 110 $ 78 1/8 Purchase 190 81 1/12 Sale 140 110 1/18 Purchase 75 81 1/20 Sale 80 120 1/24 Purchase 210 83 1/29 Sale 190 120 Which inventory method will allow company to present the highest ending inventory on the January 31, 2021 Balance Sheet? O LIFO Specific Identification Units Unit cost or selling price O FIFO O Average Costarrow_forwardOriole Company's record of transactions concerning part WA6 for the month of September was as follows. Purchases September 1 (balance on hand) 3 (a1) نا 12 292 2 16 300 200 @ 300 @ 300 @ 500 @ 300 @ $13.00 Average-cost per unit $ @ 13.10 13.25 13.30 13.30 13.40 Sales September 4 17 27 30 400 600 300 200 Calculate average-cost per unit. Assume that perpetual inventory records are kept in units only. (Round answer to 2 decimal places, eg. 2.76.)arrow_forwardBramble Corp. uses the perpetual inventory and the gross method. On March 1, it purchased $ 54000 of inventory, terms 2/10, n/30. On March 3, Bramble returned goods that cost $ 5400. On March 9, Bramble paid the supplier. On March 9, Bramble should credit a) purchase discounts for $ 1080. b) purchase discounts for $ 972. c) inventory for $ 972. d) inventory for $ 1080.arrow_forward

- Coronado uses LIFO inventory costing. At January 1, 2020, inventory was $427,200 at both cost and market value. At December 31, 2020, the inventory was $543,600 at cost and $511,200 at market value. Prepare the necessary December 31 entry under (a) the cost-of-goods-sold method and (b) loss method. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) No. Account Titles and Explanation Debit Credit (a) (b)arrow_forwarda. Differentiate between periodic inventory system and perpetual inventory system from an accounting point of view.b. Amanda Wholesale Company purchases merchandise from a variety of manufactures andsells the merchandise to a variety of retailers. The following transactions occurred duringFebruary 2020:Feb. 2. Purchased $7,600 of merchandise from Zenith manufacturing; terms are1/10, n/30.5. Paid $270 freight on February 2 purchase.11. Paid Zenith for the February 2 purchase.13. Purchased $5,000 of merchandise of Forbes Manufacturing; terms are 2/10, n/4.16. Received a $300 allowance (purchases return) for returned items on the February 13 purchase since some of the merchandise was the wrong size.17. Purchased $4,200 of merchandise from Toddler industries; terms are 2/10, n/3020. Sold merchandise with a list price of $4,000 ($2,200 cost) to valley mart.22. Valley mart returned 20% of the merchandise from the February 20 sales.23. Paid Forbes manufacturing for the February 13…arrow_forwardWhen a company uses the perpetual inventory system in accounting for its merchandise inventory, which of the following is true? Multiple Choice The inventory account is updated after each sale The inventory account is updated throughout the year as purchases are made. Cost of goods sold is computed at the end of the accounting period rather than at each sale. None of the other alternatives are correct Purchases are recorded in the cost of goods sold account.arrow_forward

- kau.3arrow_forwardWMC uses a periodic inventory system and the FIFO cost method. Required: 1. Determine the effect of these errors on retained earnings at January 1, 2021, before any adjustments. (Ignore income taxes.) 2. Prepare a journal entry to correct the errors.arrow_forwardDuring January 2019, Marta Company, which maintains a perpetual inventory system, recorded the following information pertaining to its inventory: Units Unit Cost Bal. 1/1/19 Purchased on 1/4/19 Sold on 1/20/18 Purchased on 1/25/18 Under the moving average method, what amount should Metro report as Cost of Sales on January 1,000 40 600 @ 120 900 400 @ 200 31,arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education