FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

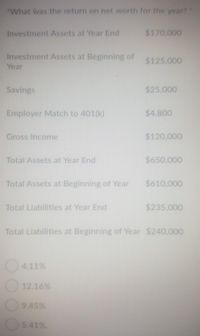

Transcribed Image Text:"What was the return on net worth for the year?"

Investment Assets at Year End

$170,000

Investment Assets at Beginning of

Year

$125,000

Savings

$25,000

Employer Match to 401(k)

$4,800

Gross Income

$120,000

Total Assets at Year End

$650,000

Total Assets at Beginning of Year

$610,000

Total Liabilities at Year End

$235,000

Total Liabilities at Beginning of Year $240,000

4.11%

O 12.16%

9.45%

5.41%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following table reports (in millions) earnings, dividends, capital expenditures, and R&D for Intel for the period 1990–95: Capital YearNet IncomeDividendsExpendituresR&D1990$650$0$680$5171991819094861819921,067431,22878019932,295881,93397019942,2881002,4411,11119953,5661333,5501,296What are the dividend payout rates for Intel during these years? Is this payout policy consistent with the factors expected to drive dividend policy, as discussed in the chapter? What factors do you expect would lead Intel’s management to increase its dividend payout? How do you expect the stock market to react to such a decision?arrow_forwardHow much net income did Wolf Enterprises earn during 2021? Net income for 2021 was Cost of services sold Accumulated depreciation Selling, general, and administrative expenses Retained earnings, December 31, 2020 $ 14,500 Service revenue 40,800 Depreciation expense Other revenue 6,100 Dividends declared Income tax expense 2,700 Income tax payable 32,400 4,200 700 700 500 1,100arrow_forwardCurrent Attempt in Progress Suppose McDonald's 2025 financial statements contain the following selected data (in millions). Current assets Total assets Current liabilities Total liabilities (a1) a. b. C. $3,330.0 Compute the following values. d. 30,230.0 3,000.0 15,719.6 Interest expense Income taxes Net income $480.0 1,938.0 4,542.0 Working capital. (Round to 1 decimal place in millions, e.g. 5,275.5.) Current ratio. (Round to 2 decimal places, e.g. 6.25:1.) Debt to assets ratio. (Round to O decimal places, e.g. 62%.) Times interest earned. (Round to 2 decimal places, e.g. 6.25.) $ millions :1 % timesarrow_forward

- Using Financial Statements for 2020, sales to working capital for the year 2020 is 2.41. True or False?arrow_forwardBalance Sheet You are evaluating the balance sheet for Campus Corporation. From the balance sheet you find the following balances: Cash and marketable securities = $391,000, Accounts receivable = $191,000, Inventory = $91,000, Accrued wages and taxes = $10,900, Accounts payable = $309,000, and Notes payable = $609,000. What is Campus's net working capital? Multiple Choice $1,601,900 О $673,000 О -$255,900 $928,900arrow_forward61. Using Financial Statements for 2018-2019. Net working capital for 2019 is $4,427,200. TRUE OR FALSE?arrow_forward

- Using the financial statements mentioned above estimate the annual rate of interest paid by the corporation (cost of debt). Also, find the tax rate and capitalization ratio (proportions among equity and debt). Using these values that you have found estimate the annual weighted cost of capital (WACC) of the corporation. Income statement PERIOD ENDING: 12/31/2019 Total Revenue $20,972,000 Cost of Revenue $17,755,000 Gross Profit $3,217,000 OPERATING EXPENSES Research and Development $0 Sales, General and Admin. $938,000 Non-Recurring Items $138,000 Other Operating Items $341,000 Operating Income $1,800,000 Add'l income/expense items $180,000 Earnings Before Interest and Tax $1,993,000 Interest Expense $394,000 Earnings Before Tax $1,599,000 Income Tax $326,000 Minority Interest $13,000 Equity Earnings/Loss Unconsolidated Subsidiary $0 Net Income-Cont. Operations $1,286,000 Net Income $1,273,000 Net Income Applicable to Common Shareholders…arrow_forwardInterpret the results: • Return on equity • Return on assets • Gross profit margin • Operating profit margin • Net profit marginarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education