ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

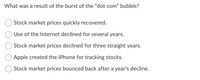

Transcribed Image Text:What was a result of the burst of the "dot com" bubble?

Stock market prices quickly recovered.

Use of the Internet declined for several years.

Stock market prices declined for three straight years.

Apple created the iPhone for tracking stocks.

Stock market prices bounced back after a year's decline.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- They act as mediators between two parties: those who supply funds and those who seek them. *A. Financial IntermediariesB. None of the choicesC. Financial SecuritiesD. DSUsE. SSUsarrow_forwardRegarding SVB bank's failure. Please list the actions you would have done differently as CEO of the bank to avoid bankruptcy.arrow_forwardSuppose that US mutual funds suddenly decide to invest more in Canada What is the long-run effect on the Canadian capital stock?arrow_forward

- Arjay plans to sell a bond that matures in one year and has a principal value of $1,000. Can he expect to receive $1,000 in the bond market for the bond? Explain.arrow_forwardIf a corporation decides to issue their shares of stocks to the public for the first time, which of the following financial intermediaries will help them? A. Mutual Fund CompaniesB. Credit UnionsC. Investment CompaniesD. Finance CompaniesE. None of the choices.arrow_forwardSuppose that you have bought a total of 3200 shares of stock of a particular company. You bought 1200 shares of stock at $18 per share, 800 shares of stock at $10 per share, and the remaining shares at $21 per share. What is the average price you paid per share of stock? (please round your answer to 2 decimal places)arrow_forward

- 61. When considering the present value of any financial asset that makes a stream of payments in the future, we know that if the market interest rate falls, the present value of the asset will rise. the current value of the asset will fall. the present value of the asset will fall. the present value of the asset is unaffected. the future value of the asset will rise.arrow_forwardA put is equivalent to shorting the underlying asset and lending, using the money account to buy more of the underlying asset as the stock price goes up. Truearrow_forwardThe main functions of the financial system include: Provide a means of making payments. Prepare to sacrifice some income to avoid uncertainty. Assist borrowing and lending. All of the abovearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education