FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

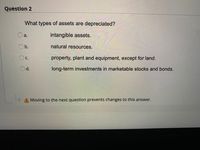

Transcribed Image Text:Question 2

What types of assets are depreciated?

a.

intangible assets.

Ob.

natural resources.

property, plant and equipment, except for land.

Oc.

Od.

long-term investments in marketable stocks and bonds.

A Moving to the next question prevents changes to this answer.

Expert Solution

arrow_forward

Step 1

SOLUTION-

DEPRECIATION IS AN ACCOUNTING METHODS OF ALLOCATING THE COST OF TANGIBLE ASSETS OVER ITS USEFUL LIFE AND ITS USED TO ACCOUNT FOR DECLINES IN VALUE OVER TIME.

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Which of the following characteristics is most likely to diff erentiate investment propertyfrom property, plant, and equipment?A. It is tangible.B. It earns rent.C. It is long-lived.arrow_forwardWhat is the 'carrying amount of a depreciating non-current asset? O A. The cost (or fair value) of the asset less the accumulated depreciation on that asset O B. The current market value of the asset C. The cost (or fair value) of the asset less the current year's depreciation O D. The cost (or fair value) of the assetarrow_forwardWhat is the difference between amortization and depreciation, and how are they applied to intangible assets?arrow_forward

- Which of the following values for an intangible asset would a company capitalize and amortize? a.) purchase price b.) research costs c.) residual value d.) development costsarrow_forwardCapital expenditures incurred subsequent to purchase of property assets increase total assets. T/Farrow_forwardHow would accumulated depreciation be classified on the balance sheet? current asset fixed asset current liability O long term liabilityarrow_forward

- Gains and Losses results from realization events such as: a. sales, purchases, exchanges, or other disposition of property. b. sales, exchanges, or other disposition of property. c. Disposition , sales and donations. d. all of the above.arrow_forwardDistinguish among depreciation, depletion, and amortization.arrow_forwardThe term "Fixed Assets" means the same thing as: Multiple Choice Intangible Assets. Current Assets. Natural Resources. Merchandise Inventory. Plant Assets.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education