FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

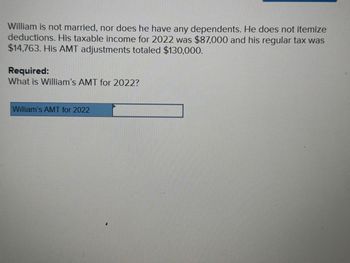

Transcribed Image Text:William is not married, nor does he have any dependents. He does not itemize

deductions. His taxable income for 2022 was $87,000 and his regular tax was

$14,763. His AMT adjustments totaled $130,000.

Required:

What is William's AMT for 2022?

William's AMT for 2022

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Patricia Gomez owns a company called Ceram-Lite which manufactures ceramic kitchenware. Over the past 10 years, Ceram-Lite has enjoyed steady growth. However, recently, there has been increased competition in kitchenware as a result of successful TV shows like Celebrity Chef. Gomez, Ceram-Lite's CEO, believes an aggressive strategy will be needed to meet the company's goals. You have been provided with the following information for the current year (2022) for Ceram- Lite's flagship Dutch Oven dish, which Gomez has indicated will be the focus product for the upcoming holiday season: Variable Costs (per dutch oven) Direct Materials Direct Manufacturing Labour Variable Overhead (manufacturing, marketing, distribution, and customer service) Total Variable cost per dutch oven Fixed Costs Selling Price Expected Sales Income tax rate Manufacturing Marketing, distribution, and customer service Total Fixed Costs 50,000 units 555 $ $ $ 18 30 28 76 $ 18,000 $ 155,760 $ 173,760 $ 88 $4,399,500 38%arrow_forwardQuestion 9: The Social Security wage base for 2021 is $142,800. Answer: A. O True В. O Falsearrow_forwardWhy did you put 2019 and 2020, when all expenses incurred in 2021 or 2022?arrow_forward

- Only need help with part Jarrow_forwardDescribe the relationships that are eligible for the Canada Care giver amount of $7348 for 2022.arrow_forwardAssuming that the cost of medical care rises 7 percent over the next year, what would the actuarially fair premium be for the next year (2019)? Total expected expenditure in 2019 = ?arrow_forward

- It's currently April of 2021. Janet decides she wants to invest 10,000 dollars at the beginning of every April (on the first) and ending on April 1, 2050. She chooses to invest in an Exchange Traded Fund with an expected return of 8% / year how much money will Janet have on April1, 2051?arrow_forwardAre the two year 10 solution calculations correct?arrow_forwardHe also wants to know how the portion of the home payment that comprises interest changes over the years assuming he takes out an FRM.arrow_forward

- An individual has determined utilizing the annuity method of capital needs analysis that he needs $1,045,656 at the beginning of his retirement to meet his retirement life expectancy goals. If this individual would like to be more conservative in his retirement planning forecast and maintain this capital balance throughout his retirement life expectancy of 32 years, given an expected earnings rate of 6%, and an inflation rate of 3% during the period, how much more would he need to have at the beginning of his retirement?arrow_forward7arrow_forwardWhat is the "catch-up" amount allowed in 202 for anyone over age 50 who has access to a SIMPLE IRA plan?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education