Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

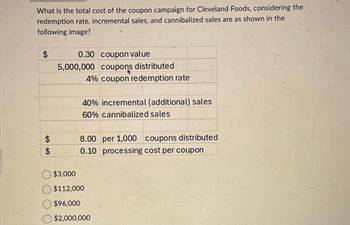

Transcribed Image Text:What is the total cost of the coupon campaign for Cleveland Foods, considering the

redemption rate, incremental sales, and cannibalized sales are as shown in the

following image?

$

0.30 coupon value

5,000,000 coupons distributed

4% coupon redemption rate

40% incremental (additional) sales

60% cannibalized sales

$

8.00 per 1,000 coupons distributed

$

0.10 processing cost per coupon

$3,000

$112,000

$96,000

$2,000,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Adam, Inc., sells a single product. The company's most recent income statement is given below. Sales Less variable expenses Contribution margin Less fixed expenses $200,000 (120,000) 80,000 (50,000) 30.000 Net income Required: Contribution margin ratio is b. a. % Breakeven point in total sales dollars is To achieve $40,000 in net income, sales must total d. $ $ С. If sales increase by $50,000, net income will increase by |4arrow_forwardConsider the following income statement for Larry & Harry drug stores: Revenue - 90mm Variable costs- 48mm Interest on debt- 6mm Depreciation- 0 mm It’s tax rate is 25% and the book value of its equity is 150mm. What is L&H’s coverage ratio? A) 0.18 B) 5.25 C) 6 D) 7 E) 8 F)15arrow_forwardProblem 1. Hobbit Company sold 700,000 boxes of chocolate chip cookies under a new sales promotion program. Each box contains one coupon, which if submitted with P40, entitles the customer to water jug. Hobbit pays P60 per jug and P5 for handling and shipping. Hobbit estimates that 70% of the coupons will be redeemed even though only 250,000 coupons had been processed in 2021. How much should Hobbit report as liability for unredeemed coupons at December 31, 2021?arrow_forward

- Jamestown Industries sells $48,000 in gift cards and expects 20% breakage. Cost of goods sold is 25% of each gift card. When the expected gift cards are redeemed, how much cost of goods sold will Jamestown record? O $12,000 $24,000 O $10,000 O $9,600arrow_forwardPlease do not give solution in image format thankuarrow_forward1) Suppose that you are given the following information Total population Working age population, non-institutionalised, non- military Unemployed If the labour force participation rate is 45%, how many are in the labour force? O A. O B. O C. O D. 38.5 18 33 22 OE. 40 60 million 40 million 1.5 millionarrow_forward

- a seller has offered credit terms of 2.5/5 net 50 to a customer that has agreed to immediately purchase 500 units at a sales price per unit of $100. variable costs are $65 per unit and involve an immediate cash outflow. the seller has an annual opportunity cost rate of 7.3%. based on this information, what is the present value of the net flows associated with the cash discount terms? is it - 16,201; 26,750; 81,201; 32,500arrow_forwardANswer with formulas for upvotesarrow_forwardPlease answer in text form , without image)arrow_forward

- Need help with answerss! will upvotearrow_forwardWhat happens if Cube Ltd. Can save 2% in purchasing costs? The purchasing cost is 85% of COGS. Analyze the Financial Impact of purchase savings in terms of Pretax profit margin, ROA, and Sales. Additional Information is as follows: Selected information about Cube Ltd. Sales BDT 10 million COGS 5.75 million Pretax Earnings 1.23 million Merchandise Inventory 1.89 million Total Asset 8 millionarrow_forwardon a a discount basis. Problem 7 COST OF TRADE CREDIT AND BANK LOAN Lamar Lumber buys $8 million of materials (net of discounts) on terms of 3/5, net 60, and it currently pays after 5 days and takes discounts. Lamar plans to expand. which will require additional financing. a) If Lamar decides to forgo discounts how much additional credit could it get and what would be the nominal and effective cost of that credit? P) J the company could get the funds from a bank at a rate of 10%, interest paid monthly, based on a 365-day year, what would be the effective cost of the bank loan? (C) Should Lamar use bank debt or additional trade credit? Explain. Page 121 of 161arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education