Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

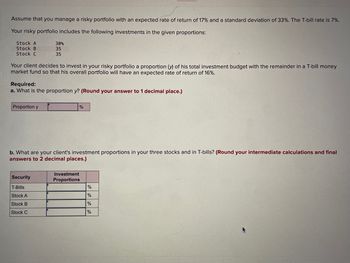

Transcribed Image Text:Assume that you manage a risky portfolio with an expected rate of return of 17% and a standard deviation of 33%. The T-bill rate is 7%.

Your risky portfolio includes the following investments in the given proportions:

Stock A

Stock B

Stock C

30%

35

35

Your client decides to invest in your risky portfolio a proportion (y) of his total investment budget with the remainder in a T-bill money

market fund so that his overall portfolio will have an expected rate of return of 16%.

Required:

a. What is the proportion y? (Round your answer to 1 decimal place.)

Proportion y

%

b. What are your client's investment proportions in your three stocks and in T-bills? (Round your intermediate calculations and final

answers to 2 decimal places.)

Security

Investment

Proportions

T-Bills

%

Stock A

%

Stock B

%

Stock C

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

please this part of the question ASAP too

What is the standard deviation of the

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

please this part of the question ASAP too

What is the standard deviation of the

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You manage a risky portfolio with an expected rate of return of 14% and a standard deviation of 28%. The T-bill rate is 7%. Your client chooses to invest 60% of a portfolio in your fund and 40% in a T-bill money market fund. Which of the following is closest to the Sharpe ratio of your client's complete portfolio? 35% 30% 25% 40%arrow_forwardYou manage a risky portfolio with an expected rate of return of 19% and a standard deviation of 32%. The T-bill rate is 7%. Your client chooses to invest 50% of a portfolio in your fund and 50% in a T-bill money market fund. Suppose that your risky portfolio includes the following investments in the given proportions: Stock A Stock B Stock C 33 % 32 % 35 % What are the investment proportions of your client's overall portfolio, including the position in T-bills? (Round your answers to 1 decimal place.) T-Bills Stock A Stock B Stock C Investment Proportions % % % %arrow_forwardAn investor can design a risky portfolio based on two stocks, A and B. Stock A has an expected return of 15% and a standard deviation of return of 16.0%. Stock B has an expected return of 11% and a standard deviation of return of 4%. The correlation coefficient between the returns of A and B is 0.50. The risk-free rate of return is 7%. The proportion of the optimal risky portfolio that should be invested in stock A is __________.arrow_forward

- K You manage a risky portfolio with an expected rate of return of 10% and a standard deviation of 37%. The T-bill rate is 4%. Your client chooses to invest 80% of a portfolio in your fund and 20% in a T-bill money market fund. What is the reward-to-volatility (Sharpe) ratio (S) of your risky portfolio? Your client's? Note: Do not round intermediate calculations. Round your answers to 4 decimal places. Your reward-to-volatility (Sharpe) ratio Client's reward-to-volatility (Sharpe) ratioarrow_forwardYou manage a risky portfolio with an expected rate of return of 10% and a standard deviation of 34%. The T-bill rate is 4%. Suppose that your client prefers to invest in your fund a proportion y that maximizes the expected return on the complete portfolio subject to the constraint that the complete portfolio's standard deviation will not exceed 10%. Required: a. What is the investment proportion, y? b. What is the expected rate of return on the complete portfolio?arrow_forwardYou manage a risky portfolio with an expected rate of return of 10% and a standard deviation of 33%. The T-bill rate is 2%. Your client chooses to invest 75% of a portfolio in your fund and 25% in an essentially risk-free money market fund. What are the expected return and standard deviation of the rate of return on his portfolio? Note: Round your answers to 2 decimal places. Expected return Standard deviation % %arrow_forward

- An investor can design a risky portfolio based on two stocks, A and B. Stock A has an expected return of 17% and a standard deviation of return of 28%. Stock B has an expected return of 15% and a standard deviation of return of 15%. The correlation coefficient between the returns of A and B is 0.8. The risk-free rate of return is 3.2%. What is the expected return on the optimal risky portfolio? Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardAn investor aims to build a portfolio with annual return equal to 8.88%. In the market only two stocks (A and B) are available, with annual historical returns equal to 9.6% and 7.8% respectively. Assume future returns have the same distribution of past returns. What is the percentage of funds that the investor must allocate to the stock A and B?arrow_forwardYou have the following information for stock portfolio A and bond portfolio B. The risk-free rate is 4.5%. THE optimal risky portfolio, P, has weights of 61.69% in A and 38.31% in B and has a standard deviation of 15.35%. What is the expected return of the optimal complete portfolio for an investor with a risk aversion parameter of A = 1.8? A producer wants to set up a hedge on its expected November purchase of 60,000 bushels of soybeans using the November soybean futures contract. The current spot price for soybeans is 1105 and the current November soybean futures price is 1176. At delivery in November the soybean spot price is 1130. The producer buys the soybeans in the spot market and closes the soybeans futures position. What is the effective price per bushel the producer pays for the soybeans? The expected return on the market is 12.0% and the risk-free rate is 4.0%. A stock with a beta of 1.3 has an expected return of 14.4%. Analysts expect the stock to pay a dividend…arrow_forward

- Assume you wish to hold a portfolio consisting of Loblaw stock and a riskless asset. Given the following information, calculate portfolio expected returns and portfolio betas, letting the proportion of funds invested in Loblaw range from 0 to 125% Loblaw has a beta (\ beta) of 1.2 and an expected return of 18% Risk-free rate is 7%. Loblaw weights: 0%, 25%, 50%, 75%, 100%arrow_forwardAn investor can design a risky portfolio based on two stocks, A and B. Stock A has an expected return of 21% and a standard deviation of return of 39 %. Stock B has an expected return of 14% and a standard deviation of return of 20%. The correlation coefficient between the returns of A and B is .4. The risk-free rate of return is 5%. The standard deviation of returns on the optimal risky portfolio is Multiple Choice 25.5% 22.3% 21.4% 20.7% O 11:18PM 20/200arrow_forwardAn investor can design a risky portfolio based on two funds, HighYieldBond and SmallCapStock. Fund HighYieldBond has an expected return of 20% and a standard deviation of return of 34%. Fund SmallCapStock has an expected return of 25% and a standard deviation of return of 38%. The correlation coefficient between the returns on HighYieldBond and SmallCapStock is 0.31. If an investor puts 0.45 into fund HighYieldBond, what is the standard deviation of the return on this portfolio?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education