Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

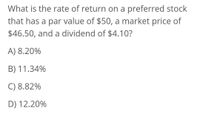

Transcribed Image Text:What is the rate of return on a preferred stock

that has a par value of $50, a market price of

$46.50, and a dividend of $4.10?

A) 8.20%

B) 11.34%

C) 8.82%

D) 12.20%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- D Given the following data and assume the margin listed, what will be your equity position in the stock? Shares Price Margin New Price O 17% O 40% 2500 O 100% $10 50% O None of these are correct O 25% $6.0arrow_forwardA stock has had the following year-end prices and dividends: TIT Year Price Dividend $16.25 1 18.43 $ .15 2 19.43 .30 3 17.93 .33 4 20.27 .34 23.38 .40 What are the arithmetic and geometric returns for the stock? (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) Arithmetic return |% Geometric returnarrow_forward1. Consider the three stocks in the following table. P, represents price at time t, and Q, represents shares outstanding at time t. Calculate the rates of return on the following indexes of the three stocks: A B с Po 90 50 100 a. A market-value-weighted index. b. An equally weighted index. Qo 100 200 200 P₁ 95 45 110 Q₁ 100 200 200arrow_forward

- the last question, please.arrow_forwardSuppose that you have estimated the following model for a broad cross section of stocks: r(t) = 3% + 2*Dividend_yield(t-1) - 1*ln(Market_capitalization(t-1)) + 3*Book/Market(t-1)Company AC's stock currently is priced such that it offers a 3% dividend yield, has a ln(Market Cap) of 1.6, and a book/market ratio of 1. According to your model, what is AC's expected stock price return for next year? Group of answer choices 3.8% 5.8% 6.5% 10.4% 13.6%arrow_forwardProvide Answer with calculation and explanationarrow_forward

- Share commom stock dividend is $1.00 , g=5.4 and required return is 11.4%, What is the stock price?arrow_forwardAn index consists of the following securities and has an index divisor of 3.0. What is the price-weighted index return? Index Stock Shares Outstanding 1,000 Beginning Share Price $26 Ending Share Price 4,000 $32 $28 $30 3,000 $19 $ 22 DEF 9.33% 10.35% 11.54% 12.33% 13.00%arrow_forward1. (a) What are the two components of most stocks’ expected total return?(b) How does one calculate the capital gains yield and the dividend yield of a stock?(c) If D1 = RM3.00, P0 = RM50, and the expected P at t=1 is equal to RM52, what are the stock’s expected dividend yield, capital gains yield, and total return for the coming year?2. (a) Are stock prices affected more by long-term or short-term performance? Explain.(b) A stock is expected to pay a dividend of RM2 at the end of the year. The required rate of return is rs = 12%. What would the stock’s price be if the growth rate were 4%?What would the stock’s price be if the growth rate were 0%?3. If D0 = RM4.00, rs = 9%, and g = 5% for a constant growth stock, what are the stock’s expected dividend yield and capital gains yield for the coming year?4. (a) Explain what is meant by the terms “horizon (terminal) date” and “horizon (terminal) value”.(b)Suppose D0 = RM5.00 and rs = 10%. The expected growth rate from Year 0 to Year 1 (g0…arrow_forward

- Stock A has a capital gains yield of 6.5% and a dividend yield of 1.5%. Stock B has a capital gains yield of 8.5% and a dividend yield of 3.5%. Which stock has the higher required return? S en O A O They have the same required return.arrow_forwardA perpetual preferred stock pays a $1.65 annual dividend and has a required return of 5.81%. The value is closest to A. $28.40. B. $31.33. C. $33.79. D. $36.55.arrow_forwardAn index consists of the following securities. What is the value-weighted index return? Value-weighted Stock Shares Outstanding Beginning Share Price Ending Share Price L 4,000 $ 18 $ 26 M 3,000 $ 35 $ 41 Multiple Choice 22.03% 22.85% 25.25% 28.25% 30.00%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education