Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

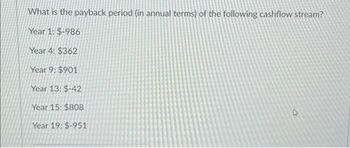

Transcribed Image Text:What is the payback period (in annual terms) of the following cashflow stream?

Year 1: $-986

Year 4: $362

Year 9: $901

Year 13: $-42

Year 15: $808

Year 19: $-951

4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- How can we compute incremental cash flow, and IRR?arrow_forwardDistinguish between annual income in the presence of depreciation and annual operating cash flow?arrow_forwardthe major purpose of which of the following is to prepare an accurate estimate of future cash flows? A. Operating budget B. Cash budget C. Capital budget D. Executive budgetarrow_forward

- What does the term "Net Present Value (NPV)" represent in finance? a) The total revenue generated by an investment b) The difference between the present value of cash inflows and the present value of cash outflows c) The total cost of an investment project d) The total profit earned from an investmentarrow_forwardWhich investment criteria answers the question: "How quickly do we recover our investment, in nominal dollars?" A) net present value B) internal rate of return C) profitability index D) payback periodarrow_forwardDirection: Define, draw the cash flow diagram, and write the general formula of the following: ANNUITY 1. Ordinary Annuity a) Sum/Future of Ordinary Annuity b) Present Worth of Ordinary Annuity 2. Annuity Due 3. Deferred Annuityarrow_forward

- How do you take the present value of a stream of cash flows. How does it work for annual payments, weekly payments, quarterly payments, and monthly payments? Provide examples of eacharrow_forwardThe rate of return that equates the present value of cash inflows and outflows is the: A. hurdle rate.B. desired rate of return.C. internal rate of return. D. minimum rate of return.arrow_forwardQuestion: Which of the following methods of capital budgeting accounts for the time value of money? Options: A) Net Present Value (NPV) B) Payback Period C) Accounting Rate of Return (ARR) D) Profitability Index (PI)arrow_forward

- How can we develop the cash flow series over the project life based on the assumption of most likely estimates?arrow_forwardWhich figure of merit provides an interest rate at which the present value of the future cash flows equals the amount invested? a) NPV b) IRR c) Cap Rate d) DCF Please ensure accuracy and explain your choicearrow_forwardThe process of finding the future value of a present sum is called: A. Amortizing B. Budgeting C. Discounting D. Compoundingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education