Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

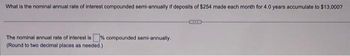

Transcribed Image Text:What is the nominal annual rate of interest compounded semi-annually if deposits of $254 made each month for 4.0 years accumulate to $13,000?

The nominal annual rate of interest is % compounded semi-annually.

(Round to two decimal places as needed.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- K What is the nominal annual rate of interest compounded monthly at which $1070.00 will accumulate to $1383.53 in four years and six months? The nominal annual rate of interest is (Round the final answer to four decimal places as needed. Round all intermediate values to six decimal places as needed)arrow_forwardA three-year bank CD paying 7.02 percent compounded quarterly. Calculate effective annual interest rate (EAR)? (Round answer to 2 decimal places, e.g. 15.25%.)arrow_forward$2350 was borrowed 4-years ago, is to be settled by following payments: $1175 today, $1030 in 7-months from now, and a final payment in 19-months from now. What is the BALANCE(amount owing) of the loan BEFORE the following payments if the interest rate on the loan is 14% compounded monthly? Today in 7 months in 19 months $ $ $ (Round All Answers to 2 Decimals)arrow_forward

- What cash payment is equivalent to making payments of $1471.00 at the end of every year for 8 years if interest is 12% per annum compounded quarterly? The cash payment is S (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.)arrow_forwardFind the nominal annual rate of interest compounded quarterly that is equivalent to 4.8% compounded semi-annually. The nominal annually compounded rate of interest is %. (Round the final answer to four decimal places as needed. Round all intermediate values to six decimal places as needed.)arrow_forwardFind the accumulated value of payments which total 640 per year paid in equal installments at the start of each quarter for 5 years. The nominal rate of interest compounded monthly is 8%. Round your answer to two decimal placesarrow_forward

- If $1125.00 accumulates to $1248.19 in two years, six months compounded semi-annually, what is the effective annual rate of interest? The effective annual rate of interest is %.arrow_forwardA three-year bank CD paying 6.82 percent compounded monthly. Calculate effective annual interest rate (EAR)? (Round answer to 2 decimal places, e.g. 15.25%.) Effective annual rate % A three-year bank CD paying 7.32 percent compounded annually. Calculate effective annual interest rate (EAR)? (Round answer to 2 decimal places, e.g. 15.25%.)arrow_forward4. A bank CD that pays 7.38 percent compounded semiannually. (Round answer to 2 decimal places, e.g. 15.25%.) what is the Effective annual rate %?arrow_forward

- How much will deposits of $35 made at the end of each month amount to after 12 years if interest is 4% compounded quarterly? The deposits will amount to S (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.)arrow_forwardWhat is the nominal annual rate of interest compounded semi-annually if deposits of $224 made each month for 4.0 years accumulate to $12,700? The nominal annual rate of interest is % compounded semi-annually. (Round to two decimal places as needed.)arrow_forward3. A bank CD that pays 7.58 percent compounded annually. (Round answer to 2 decimal places, e.g. 15.25%.) what is the Effective annual rate %?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education