ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

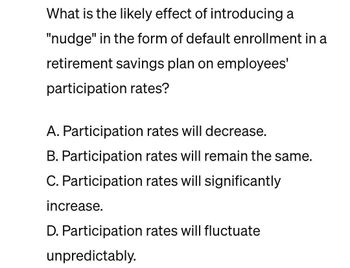

Transcribed Image Text:What is the likely effect of introducing a

"nudge" in the form of default enrollment in a

retirement savings plan on employees'

participation rates?

A. Participation rates will decrease.

B. Participation rates will remain the same.

C. Participation rates will significantly

increase.

D. Participation rates will fluctuate

unpredictably.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- what happens when expected profit equal total investmentarrow_forwardV = D + E Value of Asset = Debt + Net Worth According to normal economic theory, when will people who borrow money (D) to help buy an asset (V) tend to act in the most trustworthy way? V - D > 0 D - E < V D > E V/D > 1 + E/Darrow_forwardExplain Net-Present-Worth Criterion?arrow_forward

- Scenario 21-3 Scott knows that he will ultimately face retirement. Assume that Scott will experience two periods in his life, one in which he works an earns income, and one in which he is retired and earns no income. Scott can earn $250,000 during his working period and nothing in his retirement period. He must both save and consume in his work period with an interest rate of 10 percent on savings. Refer to Scenario 21-3. If the interest rate on savings increases, a. Scott will always increase his savings in the work period. b. Scott will increase his savings in the work period if the income effect is greater than the substitution effect for him. c. Scott will decrease his savings in the work period if the income effect is greater than the substitution effect for him. Od. Scott will decrease his savings in the work period if the substitution effect is greater than the income effect for him. Carrow_forwardsuppose you discover a treasure of $10 billion in cash. a. Is this a real or financial asset? b. Is society any richer for the discovery? c. Are you wealthier? d. Can you reconcile your answers to (b) and (c)? Is anyone worse off as a result of the discovery?arrow_forward10. What is the present value of a perpetuity of $100 if the appropriate discount rate is 7%? If interest rates in general were to double and the appropriate discount rate rose to 14%, what would happen to the present value of the perpetuity?arrow_forward

- Define Purchase of Investment.arrow_forwardKevin's reference dependent utility over money is y and effort is E, refer to the: instantaneous utility function: rt: reference point for wealth, which demonstrated his recent wealth Kevin does not have from money but from gains and losses of money instead. There is no discounting, and assume that Kevin's current wealth from his job is 0. Kevin is thinking about a new role at work which allows him to increase his income by $1000 per period for two periods, counting from the current period, which is t = 0. He must undergo a training which require an effort of EO = 3500 at that value of alpha, how much ultility would Kevin lose relative to his non-projection-biased preferences if she took the position 1000 250 500 750arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education