FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

What is the interest income on the bond investment for the year 2022?

What is the carrying amount of the bond investment on December 31, 2022?

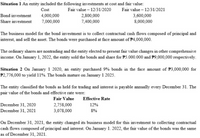

Transcribed Image Text:Situation 1 An entity included the following investments at cost and fair value:

Cost

Fair value – 12/31/2020

Fair value – 12/31/2021

Bond investment

4,000,000

2,800,000

3,600,000

Share investment

7,000,000

7,400,000

8,000,000

The business model for the bond investment is to collect contractual cash flows composed of principal and

interest, and sell the asset. The bonds were purchased at face amount of P4,000,000.

The ordinary shares are nontrading and the entity elected to present fair value changes in other comprehensive

income. On January 1, 2022, the entity sold the bonds and share for P5.000.000 and P9,000,000 respectively.

Situation 2 On January 1 2020, an entity purchased 9% bonds in the face amount of P3,000,000 for

P2,776,000 to yield 11%. The bonds mature on January 1 2025.

The entity classified the bonds as held for trading and interest is payable annually every December 31. The

pair value of the bonds and effective rate were:

Fair Value

Effective Rate

December 31, 2020

2,758,000

12%

December 31, 2021

3,078,000

8%

On December 31, 2021, the entity changed its business model for this investment to collecting contractual

cash flows composed of principal and interest. On January 1. 2022, the fair value of the bonds was the same

as of December 31, 2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sheridan Inc. is building a new hockey arena at a cost of $2,150,000. It received a down payment of $430,000 from local businesses to support the project, and now needs to borrow $1,720,000 to complete the project. It therefore decides to issue $1,720,000 of 10- year, 10.5% bonds. These bonds were issued on January 1, 2023, and pay interest annually on each January 1. The bonds yield 10.5% to the investor and have an effective interest rate to the issuer of 10.40530%. (There is an increased effective interest rate due to the capitalization of the bond issue costs.) Any additional funds that are needed to complete the project will be obtained from local businesses. Sheridan paid and capitalized $43,000 in bond issuance costs related to the bond issue. Sheridan prepares financial statements in accordance with IFRS.arrow_forward3. Prepare the journal entries to record the issuance of the bonds by Sanyal and Barnwell’s investment on February 1, 2024. 4. Prepare the journal entries by both firms to record all events related to the bonds through January 31, 2026. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)arrow_forwardPrepare a schedule of interest expense and bond amortization for 2025-2027. (Round answer to 2 decimal places, e.g. 38,548.25.) Date 1/1/25 $ 12/31/25 12/31/26 12/31/27 Cash Paid Schedule of Interest Expense and Bond Premium Amortization Effective-Interest Method $ Interest Expense $ Premium Amortized $ Carry Value ofarrow_forward

- answer in text form please (without imagearrow_forwardMartel Industries issues a bond on June 1, 2020, that will mature on June 1, 2040. Martel stipulates that bondholders may sell their bonds back to Martel after 5 years (on June 1, 2025) at 100% of par. This is an example of what type of bond offering? O Secured O Putable O Callable O Convertiblearrow_forwardGadubhaiarrow_forward

- A $10 000 bond with 5% interest payable quarterly, redeemable at par on November 15, 2034, was bought on July 2, 2018, to yield 9% compounded quarterly. If the bond sells at 92.75 on September 10, 2024, what would the gain or loss on the sale be? Show manual working.arrow_forwardThe bonds mature on December 31, 2033 (10 years). For bonds of similar risk and maturity, the market yield is 12%. Interest is paid semiannually on June 30 and December 31. Required: 1. Determine the price of the bonds at January 1, 2024. 2. to 4. Prepare the journal entries to record their issuance by The Bradford Company on January 1, 2024, interest on June 30, 2024 (at the effective rate) and interest on December 31, 2024 (at the effective rate). Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Complete this question by entering your answers in the tabs below. Req 1 Req 2 to 4 Determine the price of the bonds at January 1, 2024. Note: Enter your answer in whole dollars. Price of bondsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education