Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

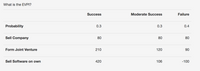

Transcribed Image Text:### Expected Value of Perfect Information (EVPI)

This table provides data for calculating the Expected Value of Perfect Information (EVPI) based on different business outcomes: Success, Moderate Success, and Failure. The table is structured to show the probabilities and profits associated with three strategic options: Sell Company, Form Joint Venture, and Sell Software on Own.

#### Table Overview:

- **Columns:**

- **Success**

- **Moderate Success**

- **Failure**

- **Rows:**

- **Probability:**

- Success: 0.3

- Moderate Success: 0.3

- Failure: 0.4

- **Profit Outcomes (based on strategic choices):**

- **Sell Company:**

- Success: 80

- Moderate Success: 80

- Failure: 80

- **Form Joint Venture:**

- Success: 210

- Moderate Success: 120

- Failure: 90

- **Sell Software on Own:**

- Success: 420

- Moderate Success: 106

- Failure: -100

To calculate the EVPI, consider the expected monetary value (EMV) under different scenarios without perfect information and compare it with the expected outcomes with perfect information. This requires assessing the best decision based on each probability-weighted outcome and determining the additional benefit of having perfect information.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Give typing answer with explanation and conclusionarrow_forwardplease answer without copy paste and with all work like explanation , computation, formula with steps need correct and complete answer for better understanding please answer in text no AI no handwritten no image need accurate answer need answer in text no copy from other answer help part b with workingarrow_forwardno explain just answer the corrcet answeer, if u do i give u 5 stararrow_forward

- Give typing answer with explanation and conclusionarrow_forwardWhat’s the answer please ?arrow_forwardWhich of the following is not a central problem of an economy? A) What to produce B) How to produce C) For whom to produce D) When to produce Don't use chatgpt or other ai tool. If you know correct answer then attempt if you gave wrong answer I will give 10 dislikes and more from my friends accountarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education