Determining transfer pricing

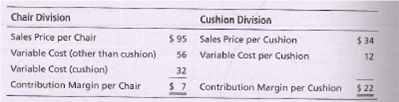

The Hernandez Company is decentralized, and divisions are considered investment centers. Hernandez has one division that manufactures oak dining room chairs with upholstered seat cushions. The Chair Division cuts, assembles, and finishes the oak chairs and then purchases and attaches the seat cushions. The Chair Division currently purchases the cushions for $32 from an outside vendor. The Cushion Division manufactures upholstered seat cushions that are sold to customers outside the company. The Chair Division currently sells 1,800 chairs per quarter, and the Cushion Division is operating at capacity, which is 1,800 cushions per quarter. The two divisions report the following information:

Requirements

- Determine the total contribution margin for Hernandez Company for the quarter.

- Assume the Chair Division purchases the 1,800 cushions needed from the Cushion Division at its current sales price. What is the total contribution margin for each division and the company?

- Assume the Chair Division purchases the 1,800 cushions needed from the Cushion Division at its current variable cost. What is the total contribution margin for each division and the company?

- Review your answers for Requirements 1, 2, and 3. What is the best option for Hernandez Company?

- Assume the Cushion Division has capacity of 1,800 cushions per quarter and can continue to supply its outside customers with 1,800 cushions per quarter and also supply the Chair Division with 1,800 cushions per quarter. What transfer price should Hernandez Company set? Explain your reasoning. Using the transfer price you determined, calculate the total contribution margin for the quarter.

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

What is the best option for Hernandez Company and why?

What is the best option for Hernandez Company and why?

- Transfer Pricing Aulman Inc. has a number of divisions, including a Furniture Division and a Motel Division. The Motel Division owns and operates a line of budget motels located along major highways. Each year, the Motel Division purchases furniture for the motel rooms. Currently, it purchases a basic dresser from an outside supplier for $40. The manager of the Furniture Division has approached the manager of the Motel Division about selling dressers to the Motel Division. The full product cost of a dresser is $29. The Furniture Division can sell all of the dressers it makes to outside companies for $40. The Motel Division needs 10,000 dressers per year; the Furniture Division can make up to 50,000 dressers per year. Also, assume that the company policy is that all transfer prices are negotiated by the divisions involved. Required: 1. What is the maximum transfer price? Which division sets it? 2. What is the minimum transfer price? Which division sets it? 3. Conceptual Connection: If…arrow_forwardThe Compressor Division and the Fabrication Division of Plash Company, which exclusively produces one type of washing machine, respectively, are its two divisions. For the Fabrication Division, which completes the washing machine and sells it to retailers, the Compressor Division makes compressors. The Fabrication Division buys compressors from the Compressor Division. The Fabrication Division will spend $40.00 on a compressor, which is the market price. (Skip updates to the inventory.) It is expected that the fixed costs for the Compressor Division remain constant for orders between 5,000 and 10,000 units. The Fabrication Division's fixed expenses are estimated to be $7.50 per unit at 10,000 units. Compressor's costs per compressor are: Direct materials $15.00 Direct labor $7.25 Variable overhead $3.00 Division fixed costs $7.50 Fabrication's costs per completed air conditioner are: Direct materials $150.00 Direct labor $62.50 Variable overhead $20.00 Division fixed costs $7.50 Assume…arrow_forwardWashington Company has two divisions, Jefferson and Adams. Jefferson produces an item that Adams could use in its production. Adams currently is purchasing 100,000 units from an outside supplier for $78.40 per unit. Jefferson is currently operating at full capacity of 900,000 units and has variable costs of $46.40 per unit. The full cost to manufacture the unit is $59.20. Jefferson currently sells 900,000 units at a selling price of $86.40 per unit. Required: 1. What will be the effect on Washington Company's operating profit if the transfer is made internally? 2. What will be the change in profits for Jefferson if the transfer price is $67.20 per unit? 3. What will be the change in profits for Adams if the transfer price is $67.20 per unit?arrow_forward

- Dwyran Ltd. manufactures a number of different products and has recently employed Ruth Benton as its management accountant. Ruth is currently looking at the various products and processes within Dwyran Ltd. to increase profitability, as a measure to try to avoid redundancies. Ruth has identified 4 areas of that she would like to look at first and she has asked you to provide her with the following information. Dwyran Ltd. manufacture the Newborough which it sells for £40 a unit. The direct material cost is £8 per unit. Other factory costs are £60,000 each month. The bottleneck factor of the production is the assembly of the unit, which is a labour intensive process. There are 20,000 labour hours available in assembly each month. Each unit of the Newborough takes 2 hours to assemble. Calculate the Newborough’s budgeted rate per factory hour and through put ratio for the month.arrow_forwardim.arrow_forwardThe Eastern division sells goods internally to the Western division of the same company. The quoted external price in industry publications from a supplier near Eastern is $200 per ton plus transportation. It costs $20 per ton to transport the goods to Western. Eastern's actual market cost per ton to buy the direct materials to make the transferred product is $100. Actual per ton direct labor is $50. Other actual costs of storage and handling are $40. Assuming there is an excess capcity in the Eastern Division, the minimum and maximum transfer price are:arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education