FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

A) What is the APR for purchases made using this credit card?

B) What is the maximum amount that Marcus can put on this credit card?

C) Did Marcus pay off the entire balance of his credit card last month?

D) Suppose Marcus pays the minimum payment due this month, what will his new balance be, after this payment is processed and assuming he makes no additional purchases?

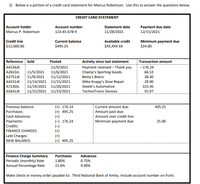

Transcribed Image Text:2) Below is a portion of a credit card statement for Marcus Robertson. Use this to answer the questions below.

CREDIT CARD STATEMENT

Account holder

Account number

Statement date

Payment due date

12/15/2021

Marcus P. Robertson

123-45-678-9

11/28/2021

Credit line

$12,000.00

Minimum payment due

$24.00

Current balance

Available credit

$495.25

$XX,XXX.XX

Reference Sold

Posted

Activity since last statement

Transaction amount

- 176.24

11/9/2021

11/6/2021

11/12/2021

11/14/2021 11/15/2021

11/19/2021 11/20/2021

11/22/2021 11/23/2021

A4236JK

Payment received – Thank you

Champ's Sporting Goods

Betty's Bistro

Mike Knapp's Shoe Repair

Steele's Automotive

11/5/2021

11/9/2021

A2653JL

66.53

A3751JK

28.30

A4231JK

29.00

A7230JL

315.45

A5641JK

TechnoTronic Devices

55.97

(+) 176.24

(+) 495.25

(+)

(-) 176.24

(-)

(+)

(+)

(=) 495.25

Previous balance:

Current amount due:

495.25

Purchases:

Amount past due:

Cash Advances:

Payments:

Amount over credit line:

Minimum payment due:

25.00

Credits:

FINANCE CHARGES:

Late Charges:

NEW BALANCE:

Finance Charge Summary

Periodic (monthly) Rate

Annual Percentage Rate

Purchases

Advances

1.80%

0.75%

21.6%

9.00%

Make check or money order payable to: Third National Bank of Amity. Include account number on front.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Kwaku Addo earns $4200 per month take-home pay and has the funds directly deposited in his checking account. He spends only about $3500 per month, and the excess funds have been building up in his account for about one year. (a) What other types of accounts are available to Kwaku? (b) How might he manage his accounts to earn as much interest as possible and keep his money safe? (c) How might he use electronic money management to accomplish these tasks?arrow_forwardBozo the clown decides to start saving money. So, every month he deposits $200 into an account which pays 4% monthly. If Bozo’s first deposit is on October 1, 2023, then how much is in the account immediately after his deposit on November 1, 2031?arrow_forwardMr. Smith did not pay his full credit card balance on June 5th, the due date each month for payment. The unpaid balance was $800. He purchased a new washing machine on credit on June 30 for $1,000. If interest is charged at a rate of 18%, compounded daily, what would be the interest charge on his next credit card bill using the average daily balance method? a) $26.63 b) $21.77 c) $14.79 d) $13.32arrow_forward

- Flip opened a credit card account. During the first month he purchased new cloths that totaled $1,505.57 and then put the card in a desk drawer and didn’t use it again. The structure of the minimum monthly payment is the interest charge plus an additional 1.9% of the remaining balance. If Flip only makes the minimum monthly payment, how long will it take for the remaining balance to be half the amount of Flip's original purchases?arrow_forwardYou have just entered college and have decided to pay for your living expenses using a credit card that has no minimum monthly payment. You intend to charge $950 per month on the card for the next 45 months. The card carries a monthly interest rate of 1%. How much money will you owe on the card 46 months from now, when you receive your first statement post-graduation?arrow_forwardMr. VanJergen's credit card uses the average daily balance method for calculating interest. His balance for the first 12 days of October was $850.00. His balance for the rest of October was $2,495.00. What was his average daily balance?arrow_forward

- Samantha and Samuel both have student credit cards issued by VISA. Their credit card statements show they are at their credit card limit of $500 this month. Samantha manages her credit well and ensures that her credit card balance is paid off in full each month before the payment deadline while Samuel cannot manage to pay off the minimum amount required each month. Complete the sentence: For Financial Statement reporting purposes, __________________________________________. a) It does not matter where Samantha or Samuel report the$500 as long as it is shown on one of their Financial Statements. b) Both Samantha and Samuel would report their $500 on their Balance Sheet as a current liability. c) Both Samantha and Samuel would report their $500 on their Cash Flow statement as an expense. d) Samantha would report her $500 on her Cash Flow statement as an expense while Samuel would report his credit card debt of $500 on his Balance Sheet as a current liability. e) Samantha would report her…arrow_forwardIf a person has ATM fees each month of $22 for 8 years, what would be the total cost of those banking lees? Totalcostarrow_forward) Samantha and Samuel both have student credit cards issued by VISA. Their credit card statements show they are at their credit card limit of $500 this month. Samantha manages her credit well and ensures that her credit card balance is paid off in full each month before the payment deadline while Samuel cannot manage to pay off the minimum amount required each month. Complete the senterice: For Financial Statement reporting purposes, a) It does not matter where Samantha or Samuel report the $500 as long as it is shown on one of their Financial Statements. b) Both Samantha and Samuel would report their $500 on their Balance Sheet as a current liability. c) Both Samantha and Samuel would report their $500 on their Cash Flow statement as an expense. d) Samantha would report her $500 on her Cash Flow statement as an expense while Samuel would report his credit card debt of 5500 on his Balance Sheet as a current liability. e) Samantha would report her $500 on her Balance Sheet as a…arrow_forward

- Michela Navarro has $3,956.71 in credit card debt. If she makes a monthly payment of $125 (and makes no additional charges on the account), how many months will it take to repay the debt if the annual interest rate on the credit card is 22.1%? Round up to the nearest month.arrow_forwardRand Company produces dry fertilizer. At the beginning of the year, Rand had the following standard cost sheet: Direct materials (8 lbs. @ $1.25) $10.00 Direct labor (0.15 hr. @ $18.00) 2.70 Fixed overhead (0.20 hr. @ $3.00) 0.60 Variable overhead (0.20 hr. @ $1.70) 0.34 Standard cost per unit $13.64 Overhead rates are computed using practical volume, which is 49,000 units. The actual results for the year are as follows: Units produced: 53,000 Direct materials purchased: 408,000 pounds at $1.32 per pound Direct materials used: 406,800 pounds Direct labor: 10,500 hours at $17.95 per hour Fixed overhead: $36,570 Variable overhead: $18,000 MPV=28,560 UNFAV MUV=21,500 FAV LRV=525 FAV LEV=45,900 UNFAV FIXED SPENDING VARIANCE= 7,170 UNFAV FIXED VOLUME VARIANCE= 2,400 FAV VARIABLE SPENDING= 150 UNFAV VARIABLE EFFICIENCY= 4,335 UNFAV Prepare journal entries for the following: The purchase of direct materials The issuance…arrow_forwardSubject: accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education