Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

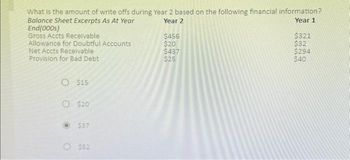

Transcribed Image Text:What is the amount of write offs during Year 2 based on the following financial information?

Balance Sheet Excerpts As At Year

Year 2

Year 1

End(000s)

Gross Accts Receivable

Allowance for Doubtful Accounts

Net Accts Receivable

Provision for Bad Debt

O $15

$20

$37

$52

$456

$20

$437

$25

$321

$32

$294

$40

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Tines Commerce computes bad debt based on the allowance method. They determine their current years balance estimation to be a credit of $45,000. The previous period had a credit balance in Allowance for Doubtful Accounts of $12,000. What should be the reported figure in the adjusting entry for the current period? A. $12,000 B. $45,000 C. $33,000 D. $57,000arrow_forwardDoer Company reports year-end credit sales in the amount of $390,000 and accounts receivable of $85,500. Doer uses the income statement method to report bad debt estimation. The estimation percentage is 3.5%. What is the estimated balance uncollectible using the income statement method? A. $13,650 B. $2,992.50 C. $136,500 D. $29,925arrow_forwardFunnel Direct recorded $1,345,780 in credit sales for the year and $695,455 in accounts receivable. The uncollectible percentage is 4.4% for the income statement method and 4% for the balance sheet method. A. Record the year-end adjusting entry for 2018 bad debt using the income statement method. B. Record the year-end adjusting entry for 2018 bad debt using the balance sheet method. C. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $13,888; record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method.arrow_forward

- Fortune Accounting reports $1,455,000 in credit sales for 2018 and $1,678,430 in 2019. It has an $825,000 accounts receivable balance at the end of 2018 and $756,000 at the end of 2019. Fortune uses the balance sheet method to record bad debt estimation at 7.5% during 2018. To manage earnings more favorably, Fortune changes bad debt estimation to the income statement method at 5.5% during 2019. A. Determine the bad debt estimation for 2018. B. Determine the bad debt estimation for 2019. C. Describe a benefit to Fortune in 2019 as a result of its earnings management.arrow_forwardConner Pride reports year-end credit sales in the amount of $567,000 and accounts receivable of $134,000. Conner uses the balance sheet method to report bad debt estimation. The estimation percentage is 4.6%. What is the estimated balance uncollectible using the balance sheet method? A. $26,082 B. $6,164 C. $260,820 D. $61,640arrow_forwardEstimating Bad Debts from Receivables Balances The following information is extracted from Shelton Corporations accounting records at the beginning of 2019: During 2019, sales on credit amounted to 575,000, 557,400 was collected on outstanding receivables and 2,600 of receivables were written off as uncollectible. On December 31, 2019, Shell on estimastes its bad debts to be 4% of the outstanding gross accounts receivable balance. Required: 1. Prepare the journal entry necessary to record Sheltons estimate of bad debt expense for 2019. 2. Prepare the Accounts Receivable section of Shelton's December 31, 2019, balance sheet. 3. Compute Shelton's receivables turnover. (Round to one decimal place.) 4. It Sheldon uses IFRS, what might be the heading for the accounts receivable section in Requirement 2?arrow_forward

- Ink Records recorded $2,333,898 in credit sales for the year and $1,466,990 in accounts receivable. The uncollectible percentage is 3% for the income statement method and 5% for the balance sheet method. A. Record the year-end adjusting entry for 2018 bad debt using the income statement method. B. Record the year-end adjusting entry for 2018 bad debt using the balance sheet method. C. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $20,254; record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method.arrow_forwardJars Plus recorded $861,430 in credit sales for the year and $488,000 in accounts receivable. The uncollectible percentage is 2.3% for the income statement method, and 3.6% for the balance sheet method. A. Record the year-end adjusting entry for 2018 bad debt using the income statement method. B. Record the year-end adjusting entry for 2018 bad debt using the balance sheet method. C. Assume there was a previous debit balance in Allowance for Doubtful Accounts of $10,220, record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method. D. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $5,470, record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method.arrow_forwardWhat is the net realizable value of accounts receivable at the end of year, given the following information:Balance in Accounts Receivable at end of year, $104,000Balance in Allowance for Doubtful Accounts, beginning of year, $2,000 debitWrite-offs during year, $5,000Bad debt expense for year, $9,000Recoveries during year of accounts previously written-off, $2,000arrow_forward

- Haresharrow_forwardAfter analyzing its accounts receivable at year-end, a company arrives at the following age categories along with the percentages estimated as uncollectible. Age of Accounts 0-30 days past due 31-60 days past due 61-120 days past due 121-180 days past due Over 180 days past due [Select] ✔ Accounts Receivable Estimated Uncollectible % Transaction Report bad debt expense $134,000 46,000 29,000 [Select] 13,000 9,000 $231,000 Assets The year-end balance of the allowance for uncollectible accounts before any adjustment is $2,300. Use the information above to answer the following questions. a. What amount of bad debt expense will the company report in its income statement for the current year? 2.0% 3.0% b. Use the financial statement effects template to show the impact of reporting this year's bad debt expense. If there is no net change in an item, select 'no net change. Balance Sheet Liabilities = 6.0% 12.0% 20.0% [Select] + Equity [Select] c. What is the net accounts receivable balance…arrow_forwardHello tutor please help me general Accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning