Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

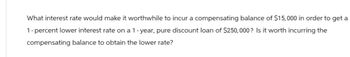

Transcribed Image Text:What interest rate would make it worthwhile to incur a compensating balance of $15,000 in order to get a

1-percent lower interest rate on a 1-year, pure discount loan of $250,000? Is it worth incurring the

compensating balance to obtain the lower rate?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Which of the following is TRUE? O An American call option on a stock should never be exercised early O An American call option on a stock should be exercised early when dividends are expected O It can sometimes be optimal to exercise early an American call option on a stock even when no dividends are expected and there is no liquidity or portfolio rebalancing need. O An American call option on a stock should never be exercised early when no dividends are expected << Previous Next ▸arrow_forwardWhich of the following statements is CORRECT? Question 2 options: a) The proportion of the payment that goes toward interest on a fully amortized loan increases over time. b) An investment that has a nomiral rate of 6% with semiannual payments will have an effective rate that is smaller than 6%. c) If a loan or investment has annual payments, then the effective, periodic, and nominal rates of interest will all be different. d) The present value of a 3-year, $150 ordinary annuity will exceed the present value of a 3-year, $150 annuity due. e) if a loan has a nominal annual rate of 7%, then the effective rate will never be less than 7%.arrow_forwardRead each of the following statements, and indicate which overdraft protection arrangement is being described. • This program frequently necessitates transfers of fixed increments (e.g., $100) and may result in greater-than-desired transfers and resulting interest charges. This describes: • This program often requires the annual fees or cash-advance feer of credit or a bank-issued credit card, and incur interest charges and An automatic overdraft loan agreement describes: • This program could still result in A courtesy overdraft/bounce protection account does not have sufficient funds to cover the overdraft. This describes: An automatic funds transfer agreementarrow_forward

- When you borrow money, you typically have to pay an interest rate. What does interest represent? a) The cost of borrowing money b) The profit earned on an investment c) A bank fee d) A penalty for late payment????arrow_forwardIf an interest rate of 8.9% compounded semi-annually is charged on a car loan, what effective rate of interest should be disclosed to the borrower?arrow_forwardWhich loan strategy would achieve some flexibility; no exposure to credit risk but exposure to repricing risk? Question 22 options: A company borrows $1 million for one year at a fixed rate, then renew the credit annually A company borrows $5 million for five years at a fixed interest rate A company borrows $5 million for five years at a floating rate, LIBOR + 1% A company borrows $1 million for one year at LIBOR + 1%, then renew the credit annuallyarrow_forward

- Which of the following statements is most correct? The first payment under a 3-year, annual payment, amortized loan for $1,000 will include a smaller percentage (or fraction) of interest if the interest rate is 5 percent than if it is 10 percent. If you are lending money, then, based on effective interest rates, you should prefer to lend at a 10 percent nominal, or quoted, rate but with semiannual payments, rather than at a 10.1 percent nominal rate with annual payments. However, as a borrower you should prefer the annual payment loan. The value of a perpetuity (say for $100 per year) will approach infinity as the interest rate used to evaluate the perpetuity approaches zero. Statements a, b, and c are all true. Statements b and c are true.arrow_forwardA borrower can obtain an 80% loan with an 8% interest rate and monthly payments. The loan is to be fully amortized over 25 years. Alternatively, he could obtain a 90% loan at an 8.5% rate with the same loan term. The borrower plans to own the property for the entire loan term. solve with finanical calucltor What is the incremental cost of borrowing the additional funds? How would your answer change if 2 points were charged on the 90% loan? Would your answer to part (b) change if the borrower planned to own the property for only 5 years?arrow_forwardQuestion 5. Attached is a similar question answeredarrow_forward

- Which of the following statements correctly describes aspects of simple interest as discussed in lectures? Group of answer choices A) With simple interest, the future value of any cash flow is simply its current value discounted back at a rate of r% per period for n periods. B) None of the other statements are correct C) A loan that has been created that pays simple interest, will involve interest payments that are calculated on the basis of both the principal amount borrowed as well as any interest that has accumulated to date. D) By convention, simple interest is the main method used for the pricing of long-term bonds. E) More than one of the other statements are correctarrow_forwardA bank has estimated its expected (predicted) loan loss rate on its consumer loans at 3.25%. If the bank wishes to earn 8% on it consumer loans, what rate should it charge its customers?arrow_forwardIf money is not an economic resource, why is interest paid and received for its use? What considerations account for the fact that interest rates differ greatly on various types of loans? Use those considerations to explain the relative sizes of the interest rates on the following:a. A 10-year $1000 government bond.b. A $20 pawnshop loan.c. A 30-year mortgage loan on a $145,000 house.d. A 24-month $12,000 commercial bank loan to finance the purchase of an automobile.e. A 60-day $100 loan from a personal finance company.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education