Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

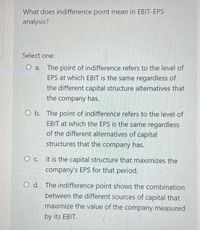

Transcribed Image Text:What does indifference point mean in EBIT-EPS

analysis?

Select one:

O a. The point of indifference refers to the level of

EPS at which EBIT is the same regardless of

the different capital structure alternatives that

the company has.

O b. The point of indifference refers to the level of

EBIT at which the EPS is the same regardless

of the different alternatives of capital

structures that the company has.

O c. It is the capital structure that maximizes the

company's EPS for that period.

O d. The indifference point shows the combination

between the different sources of capital that

maximize the value of the company measured

by its EBIT.

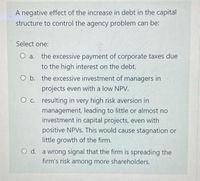

Transcribed Image Text:A negative effect of the increase in debt in the capital

structure to control the agency problem can be:

Select one:

O a. the excessive payment of corporate taxes due

to the high interest on the debt.

O b. the excessive investment of managers in

projects even with a low NPV.

O c. resulting in very high risk aversion in

management, leading to little or almost no

investment in capital projects, even with

positive NPVS. This would cause stagnation or

little growth of the firm.

O d. a wrong signal that the firm is spreading the

firm's risk among more shareholders.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- What effect would a decreased cost of capital have on a firm's future investments?arrow_forwardThe optimal capital structure for firms in stable industries can reasonably contain ________________ than firms in volatile industries. Select one: A. more debt B. less debt C. an equal amount of debt D. There is no relationship between the cyclical nature of an industry and optimal capital structurearrow_forwardSolve this onearrow_forward

- "Address the limitations of traditional methods such as CAPM (Capital Asset Pricing Model) andDiscounted Cash Flow Analysis in valuing a company's stock price in non - stationary marketconditions. Particularly, discuss the consistency of the beta coefficient in determining the cost ofcapital and the selection of the risk - free rate. Also, evaluate how these traditional models can orcannot integrate non-financial factors (e. g., company management, brand value, industry trends).Lastly, discuss the alternative models used in stock valuation and the advantages and disadvantagesof these models compared to traditional methods."arrow_forwardWhy do maximizing EPS and maximizing value not necessarily lead to the same conclusion about the optimal capital structure?arrow_forward3. Explain the relationship between the weighted average cost of capital (WACC), the maximization of firm value, and financial decision making.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education