Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:6. The Mariposa Co. has two bonds outstanding. One was issued 25 years ago at a coupon rate of 9%.

The other was issued 5 years ago at a coupon rate of 9%. Both bonds were originally issued with

terms of 30 years and face values of $1,000. The going interest rate is 14% today.

a. What are the prices of the two bonds at this time?

b. Discuss the result of part (a) in terms of risk in investing in bonds.

Transcribed Image Text:components.)

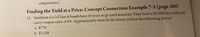

Finding the Yield at a Price: Concept Connection Example 7-3 (page 300)

11. Smithson Co.s Class A bonds have 10 years to go until maturity. They have a $1,000 face value and

carry coupon rates of 8%. Approximately what do the bonds yield at the following prices?

a. $770

b. $1,150

Expert Solution

arrow_forward

INTRODUCTION

The Yield To Maturity (YTM) is one one the method used to find out the price of bond. It gives the measure about the return from bonds. The return that the bond held at the time of maturity is the Yield To Maturity. It contains the total income earned by the investor over the of the security. The total income consist of coupon income, capital gains or losses and interest on coupon rate.

It can be calculated using the following equation:

Where,

C = Periodic coupon payments or Cash flow

F = The face value of the bond received

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Discuss how does the length of time until maturity for a bond influence the relationship between market rates of interest and bond price.arrow_forwardHow does a bond’s current yield differ from its total return?arrow_forwardDescribe the process to record a bond a face value, discount value and premium?arrow_forward

- What is the relationship between interest rate level and bond price? Why must this relationship be true? How has the current rate environment impacted the prices of bonds?arrow_forward1. What is the relationship between interest rate level and bond price? Why must this relationship be true? How has the current rate environment impacted the prices of bonds?arrow_forwardWhat is the straight-line amortization technique for a bond discount or premium?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education