ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

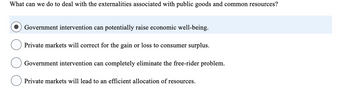

Transcribed Image Text:What can we do to deal with the externalities associated with public goods and common resources?

Government intervention can potentially raise economic well-being.

Private markets will correct for the gain or loss to consumer surplus.

Government intervention can completely eliminate the free-rider problem.

Private markets will lead to an efficient allocation of resources.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Consider the above graph. Is there an externality present in this market? If so, what kind? No, there is no externality. Yes, a negative externality. Yes, a positive externality.arrow_forwardDescribe one function of government in the economy other than correcting externalities. Provide an example.arrow_forwardToo much of a good or service is produced when there is a Private cost External benefit Public good Positive externality Negative externalityarrow_forward

- Explain why there are no markets for public goods briefly.arrow_forwardKnowledge creates positive externality; therefore, governments should intervene in the education sector. What is the intervention action of governments for efficiency to gain from external benefits? Please explain each of these interventions with a clear example for each.arrow_forwardFill in the blanks: There is ____________ in an economy with positive externality. This problem can be dealt with by providing a _______ to the individual(s) creating the positive externality.arrow_forward

- What exactly is a Pigovian tax? Give some instances of how the Pigovian tax can be used to tackle environmental issues.arrow_forwardSuppose there are only two consumers in the market for a public good. The figure to the right shows marginal benefit lines for a public good for the two individuals, Andrew (A) and Brenda (B). Use the line drawing tool to draw and label the social marginal benefit line. Make sure that the line extends from quantity level 0 to 10 as the private marginal benefit lines do. Carefully follow the instructions above, and only draw the required object. Marginal Benefit, Marginal Cost ($) 20- 18- 16- 14- có + 2- 0- -O 0 1 MC 2 3 4 5 6 7 8 9 Quantity of a Public Good MBA MBB 10 11 12 Qarrow_forwardIn a market with a negative externality, like houses being painted with lead paint, the quantity produced in the market in a competitive will be than the quantity that maximizes total surplus. higher lower the same asarrow_forward

- Market demand is MWTP= 60 - 2Q. Market supply is MC = 27 + Q. Each unit transacted results in a $Q external cost. How much is the Pigouvian tax that results the socially optimal amount of production? Enter a number only, no $ sign.arrow_forwardExternalities can be ________ by collective (i.e.) ________ action. a. enhanced // market b. internalized // market c. internalized // government d. externalized // governmentarrow_forwardIf the production of a good yields a negative externality, then the social-cost curve lies ________ the supply curve, and the socially optimal quantity is ________ than the equilibrium quantity. What are the fill in the blanks?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education