ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:Page < 2

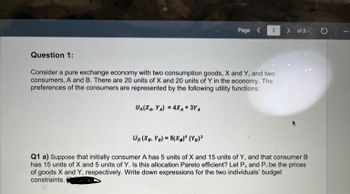

Question 1:

Consider a pure exchange economy with two consumption goods, X and Y, and two

consumers, A and B. There are 20 units of X and 20 units of Y in the economy. The

preferences of the consumers are represented by the following utility functions:

UA(XA, YA) = 4XA + 3YA

of 3

UB (XB, YB) = 5(XB)4 (YB)²

Q1 a) Suppose that initially consumer A has 5 units of X and 15 units of Y, and that consumer B

has 15 units of X and 5 units of Y. Is this allocation Pareto efficient? Let Px and Pybe the prices

of goods X and Y, respectively. Write down expressions for the two individuals' budget

constraints.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

What are the values of PX and PY in the general competitive equilibrium of this

economy? Why?

Solution

by Bartleby Expert

Follow-up Question

ketch the indifference

your diagram identify the area where there is scope for a Pareto improvement and explain why

this is the case.

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

What are the values of PX and PY in the general competitive equilibrium of this

economy? Why?

Solution

by Bartleby Expert

Follow-up Question

ketch the indifference

your diagram identify the area where there is scope for a Pareto improvement and explain why

this is the case.

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Two consumers, Budi and Marry, together have 10 apples and 4 oranges. a. Draw the Edgeworth box that shows the set of feasible allocation for the two individuals and two goods b. Suppose Budi has 5 apples and 1 orange, while Marry has 5 apples and 3 oranges. Identify this allocation in the Edgeworth box c. Suppose Budi and Marry have identical utility functions and assume that this utility function exhibits positive marginal utilities for both apples and oranges and a diminishing marginal rate of substitution of apples and oranges. Could the allocation in part (b) be economically efficient?arrow_forwardQ.2 (a) (i)Define "weakly Pareto efficient" and "strongly Pareto efficient" allocations. (ii) show that an allocation that is 'strongly Pareto efficient' is also 'weakly Pareto efficient. But in general the reverse is not true. (ii) If preferences are continuous and monotonic prove that an allocation is 'weakly Pareto efficient' if and only if it is 'strongly Pareto efficient'.arrow_forwardQuestion d)arrow_forward

- Ginny likes to eat Bertie Bott's Every Flavour Beans (b), and Chocolate Frogs (f). Her preferences over these lollies are Cobb-Douglas, and can be presented by the utility function u(b, ƒ) = (b − 2)(ƒ +3). Each Every Flavour Bean costs 25 Knuts and each Chocolate Frog costs 12 Knuts. Ginny has 314 Knuts to spend. Assume that beans and frogs are both perfectly divisible goods. (a) Find Ginny's optimal bundle. (b) Suppose that Ginny is mugged by Draco on her way to the lolly cart, so that by the time she is there, she is left only with 75 Knuts. What is her optimal bundle now? (c) Now, consider the general case, where Ginny's income is m, the price of Every Flavour Beans is po, and the price of Chocolate Frogs is given by pf. In other words, treat Chocolate Frogs as the numeraire. Find Ginny's demand for each good in terms of m, p and Pf. (d) Find the good on which Ginny will always spend more than half of her income. (e) Find the own-price, cross-price, and income elasticities of good…arrow_forwardSuppose there are two firms selling protein bars. Firm 1 sells 'AggieBars' with 10 grams of protein and firm 2 sells 'DavisBars' with 20 grams of protein. Consumers are distributed uniformly over their preferences for grams of protein between 10 and 20. Suppose firm 1 sells AggieBars for $2 and firm 2 sells DavisBars for $3. The 'cost to consumers of deviating from their optimal amount of protein is $0.20 per gram. a. What protein content does the marginal consumer (the consumer who is indifferent between AggieBars and DavisBars) prefer? The equation for finding the marginal consumer (when the range of product attribute values is 10) is V - p1 - tx m = V – p2 – t(10 – x m) 4 b. How would the proportion of consumers buying each product change if the cost to deviation from one's optimal amount of protein increased (was greater than $0.20 per gram)?arrow_forwardSuppose the utility possibility frontier for two individuals is given by U_a+2U_b=200 Please plot the utility frontier on a graph.arrow_forward

- Divya and Emily have to divide a bag of 200 pistachios between them. They derive enjoyment from pistachios according to the following hedonic utility functions: uD(x) = √x for Divya; uE (x) = 2√x for Emily (where x is the number of pistachios eaten). (a) Consider all possible ways of dividing the pistachios. Treating the utilities given above as the two agents" "levels," which division is best according to the utilitarian criterion? (b) Which division is best according to the leximin criterion? (c) Which is best according to the Nash criterion?arrow_forwardQ2. Suppose a consumer seeks to maximize the utility function U (x, y) = (x + 2) (y + 1), where x and y represent the quantities of the two goods consumed. The prices of the two goods and the consumer's income are pa, py, and I. (c) Show the bordered Hessian matrix, H for this problem. What does the second order condition require for this problem? Show if it is satisfied.arrow_forwardSuppose there are two consumers, A and B. There are two goods, X and Y. There is a TOTAL of 9 units of X and a TOTAL of 9 units of Y. The consumers' utility functions are given by: UA(X,Y) = 3X + Y UB(X,Y) = X2 Y For Each of the following allocations, answer True if it is Pareto Efficient, and False if it is not Pareto Efficient. [ Select ] Allocation A: Consumer A gets X = 7 and Y =6; Consumer B gets X = 2 and Y = 3. [ Select ] Allocation B: Consumer A gets X = 6 and Y =7; !3! Consumer B gets X = 3 and Y = 2 %3D [ Select ] Allocation C: Consumer A gets X = 2 and Y =0; Consumer B gets X = 7 and Y = 9 [ Select ] v Allocation D: Consumer A gets X = 1 and Y =0; Consumer B gets X = 8 and Y = 9arrow_forward

- please teach solve explain step by steparrow_forwardFor the case of two goods, give an example of a utility function U(x1, x2) that represents the preferences of a consumer who regards the two goods as perfect complements. Next, take the transformation f(U) = U³ of the your example utility function and explain if this newly gener ated function represents the original preferences. Further, provide clear arguments supporting or rejecting the claim that "f(U(x1, x2)) must be strongly increasing in (x1, x2)."arrow_forwardConsider the pure exchange economy with 2 goods, good 1 and good 2, and two consumers, consumer A and consumer B. Consumer A is initially endowed with 10 units of good 1 and 10 units of good 2. Consumer B is initially endowed with 2 units of good 1 and 2 units of good 2. The consumers have the following utility functions: ua(X1a,X2a)=X1AX2A²; uB(x1B,X2B)=X1B+X2g. Among the prices below, which ones are Walrasian equilibrium prices? O a. p1=3, p2 =2 O b. p1=4, P2 =5 O C. None of the other answers. O d. p1=5, p2 =4 O e. P1=2, p2 =3arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education