FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

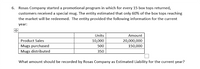

Transcribed Image Text:6. Rosas Company started a promotional program in which for every 15 box tops returned,

customers received a special mug. The entity estimated that only 60% of the box tops reaching

the market will be redeemed. The entity provided the following information for the current

year:

Units

Amount

Product Sales

10,000

20,000,000

150,000

Mugs purchased

500

Mugs distributed

350

What amount should be recorded by Rosas Company as Estimated Liability for the current year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The estimated warranty obligation at the end of the financial year is best described as a A. Uncertain liability OB. Contingent liability O C. Liability O D. Constructive liability OE. Unrecognized liabilityarrow_forwardWhich of the following is most likely to be classified and reported as a current liability? a. Prepaid Expense b. Bond Payable c. Mortgage Payable d. Unearned Revenue O None of the abovearrow_forwardWhen a contingency comes into existence after the company’s fiscal year-end, why does a liability cannot be accrued?arrow_forward

- In 2-3 paragraphs complete the following: Define gain contingency. Describe the accounting requirements for a gain contingency. Define contingency. What exactly is the company uncertain about—whether a future event will take place and result in a liability or whether a future event will take place that will confirm that a liability exists from an event that has already taken place?arrow_forwardWarranty liability is an estimate based on past warranty claims. How might a company determine how much to accrue for warranty? Why might it change the accrual?arrow_forwardAlternative Accounting Treatments a. Estimate the amount of liability and record. b. Do not record as a liability but disclose in a footnote to the financial statements. c. Neither record as a liability nor disclose in a footnote to the financial statements. Required: Match the appropriate alternative accounting treatment with each of the potential contingent liabilities listed below. Potential Contingent Liabilities 1. Income taxes related to revenue included in net income this year but taxable in a future year. 2. Potential costs in future periods associated with performing warranty services on products sold this period. 3. Estimated cost of future services under a product warranty related to past sales. 4. Estimated cost of future services under a product warranty related to future sales. 5. Estimated cost of pension benefits related to past employee services that has yet to be funded. 6. Potential loss on environmental cleanup suit against company; a court judgment against the…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education