ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

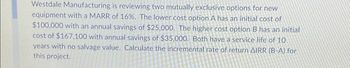

Transcribed Image Text:Westdale Manufacturing is reviewing two mutually exclusive options for new

equipment with a MARR of 16%. The lower cost option A has an initial cost of

$100,000 with an annual savings of $25,000. The higher cost option B has an initial

cost of $167.100 with annual savings of $35,000. Both have a service life of 10

years with no salvage value. Calculate the incremental rate of return AIRR (B-A) for

this project.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Apricot Computers is considering replacing its material handling system and either purchasing or leasing a new system. The old system has an annual operating and maintenance cost of $31,000, a remaining life of 8 years, and an estimated salvage value of $5,300 at that time. A new system can be purchased for $259,000; it will be worth $24,000 in 8 years; and it will have annual operating and maintenance costs of $16,000/year. If the new system is purchased, the old system can be traded in for $19,000. Leasing a new system will cost $25,000/year, payable at the beginning of the year, plus operating costs of $7,100/year, payable at the end of the year. If the new system is leased, the old system will be sold for $9,000. MARR is 15%. Compare the annual worths of keeping the old system, buying a new system, and leasing a new system based upon a planning horizon of 8 years. Click here to access the TVM Factor Table Calculator For calculation purposes, use 5 decimal places as displayed in the…arrow_forward!arrow_forwardTwo traffic signal systems are being considered for an intersection. One system costs $31,000 for installation and has an efficiency rating of 80%, requires 26 kW power (output), incurs a user cost of $0.23 per vehicle, and has a life of 9 years. A second system costs $47,000 to install, has an efficiency rating of 87%, requires 34 kW power (output), has a user cost of $0.19 per vehicle, and has a life of 17 years. Annual maintenance costs are $75 and $95, respectively. MARR = 8% per year. How many vehicles must use the intersection to justify the second system when electricity costs $0.09/kWh? Assume salvage value for each system equals zero. Project the difference in the user cost as savings for the second system. There are approximately 8,760 hours/year. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 8% per year. At least 108000 vehicles per day must use the intersection to justify the second system. (Round up to the nearest whole…arrow_forward

- Three independent project R, S, & T. If the PW of these projects at MARR is as follows: PWS= $80,000, PWR = -$50,000, PWT = $70,000. Write down the bundles that you can be immediately excluded from the analysis.arrow_forwardA company purchases manufacturing equipment for $ 3,950,000. The company produces 1,800 units of production per year. The revenue associated with each production unit is $ 1,310. The total annual costs per production unit is $ 630. a) What is the non-discounted payback period? b) What is the payback period if MARR = 20.00% Answer to part b) can be within a 1 year range.arrow_forwardWhat is the payback period for a project with the following characteristics, given a minimum attractive rate of return (MARR) of 12%? First Cost $20,000 Annual Benefits $8,000 Annual Maintenance $2,000 in year 1, then increases by $500 per year Salvage value $2,000 Useful Life 10 yearsarrow_forward

- A distribution company is considering three different alternatives to satisfy their customer's demands. Their options are to rent a ready distribution center (D01), Rent and mobilize a center (D02), or outsourcing (OS). The estimate for each method is shown. The lifetime for D01, D02, and OS are 3, 6, and 2 respectively. MARR is 0.04 per year, and the percentage of change for all of the cases are 0 % Note: all units are in thousand $ D01 First Cost, $ Annual Operation Cost, $ Salvage Value, $ a: Calculate the Fw of D01? -136 -92 28 D02 OS -973 0 -59 -123 333 0arrow_forwardMachine A costs Q10,000.00, with a recovery value of Q4,000.00 at the end of 5 years and has annual expenses ofoperation of Q5,000.00 during the first three years and Q6,000.00 during the last 2. Machine B costsQ14,000.00, with a recovery value of Q3,000.00 at the end of 10 years. Its operating expenses amount to Q3,500.00annually during the 5 years and Q4,500.00 during the last 5. The increases in operating expenses are theexpected for maintenance, repair and loss of efficiency due to use. The minimum required rate of returnis 15%a) Make the graph and determine the annual cost and make the respective comparison between the two machines.b) Select the most feasible machine.c) Determine the future worth in year 10 for both machines.d) Determine the quarterly value during the 10 years for both machines.e) As an Engineer you are asked to determine an action plan, define objectives, activities to overcome the bestalternative and estimating a new NPV, which exceeds 15% the best optionf)…arrow_forwardThe Civil Engineering department at RRCP plans to purchase a 3D printer for the CARSI lab. One option is the purchase of a brand new machine (purchase price $1900), and will have a salvage value of $700 after three years. A second option is the purchase of a refurbished machine (purchase price $1200), which will cost $250 per year to maintain, with a salvage value of $250 after three years. What is the interest rate that will make these two options equivalent with respect to Present Worth?arrow_forward

- Texas Popcorn Corporation is planning to fully automate it process. The company CEO is currently looking into three options. Options A costs $450,000, AOC of $55,000, and salvage value of $85,000 after 3 years. Option B will cost $720,000 with an AOC of $68,000 and salvage of $95,000 after 4 years. Option C cost $800,000 with an AOC of $95,000 and salvage of $125,000 after 6 years. Which machine should the company select at an interest rate of 10% per year? Use annual worth analysis. Assume the project service life is 12 years. Please provide hand written solution.arrow_forwardAn aerodynamic three-wheeled automobile (the Dart) runs on compressed natural gas stored in two cylinders in the rear of the vehicle. The $15,000 Dart can cruise at speeds up to 85 miles per hour, and it can travel 95 miles per gallon of fuel. Another two-seater automobile costs $11,000 and averages 45 miles per gallon of compressed natural gas. If fuel costs $8.00 per gallon and MARR is 12% per year, over what range of annual miles driven is the Dart more economical? Assume a useful life of six years for both cars. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 12% per year. Dart is more economical if you are planning on driving miles or more per year. (Round to the nearest whole number.)arrow_forwardM11arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education